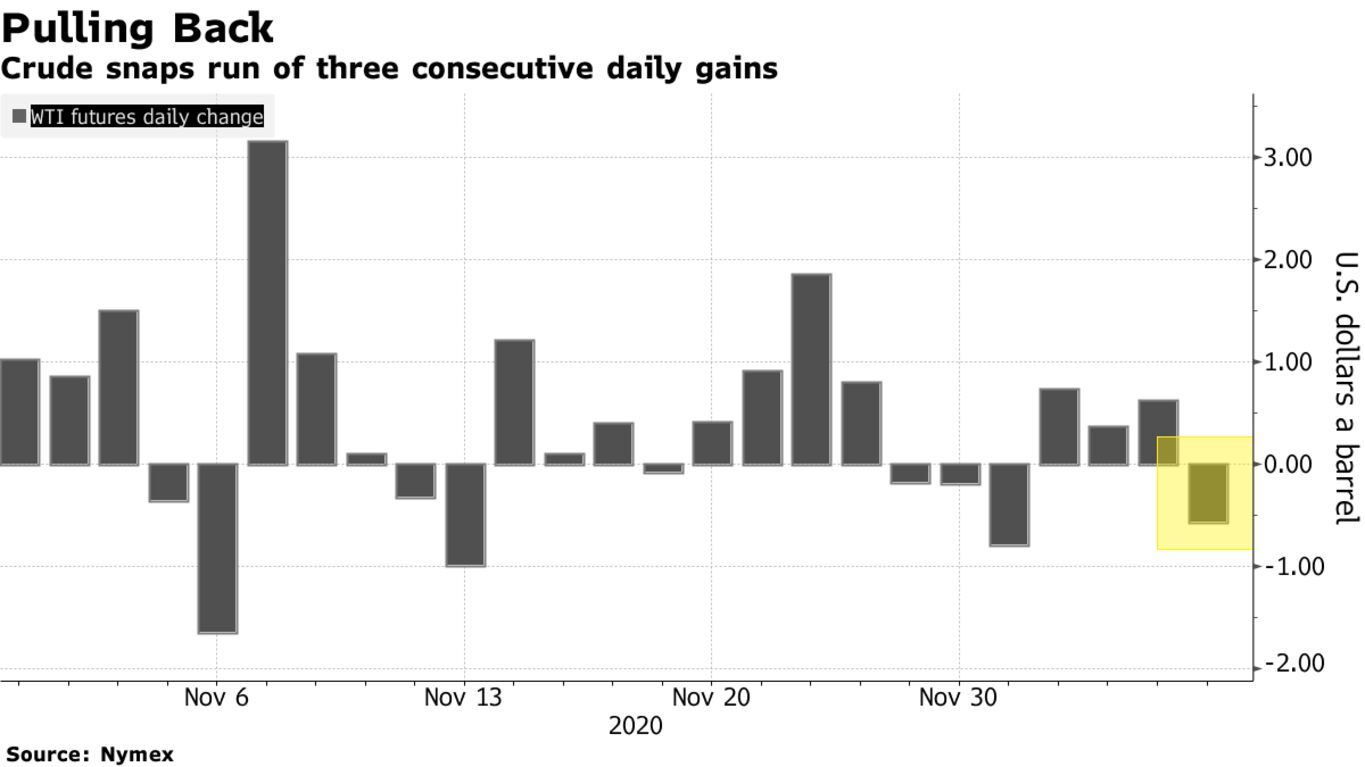

Oil fell from its strongest close in nine months, hampered by weaker risk sentiment in global markets. Crude futures were down 1.9% in New York, with the dollar trading higher and European stock markets declining. It follows a rally last week after OPEC and its allies agreed to add 500,000 barrels a day of output from January to a market that’s showing signs of recovery.

In the short-term, there are indications that consumption in Asia remains robust. Saudi Arabia raised oil pricing for the region, a signal the kingdom is confident demand is strong enough to absorb the small boost in supply. China’s economy appears robust, with exports rising the most since early 2018 last month to jump more than 20% in dollar terms.

“The oil market will see better days in 2021, it’s almost certain, but it still has to overcome a short-term hurdle for a couple of months until demand picks up, and this will constrain prices for the time being,” said Bjornar Tonhaugen, head of oil markets at Rystad Energy.

| PRICES |

|---|

|

The effects of the demand recovery in Asia are also rippling around the world. Rising buying interest from the region has pushed up physical prices for North Sea oil, with Forties crude climbing to the highest level since late August.