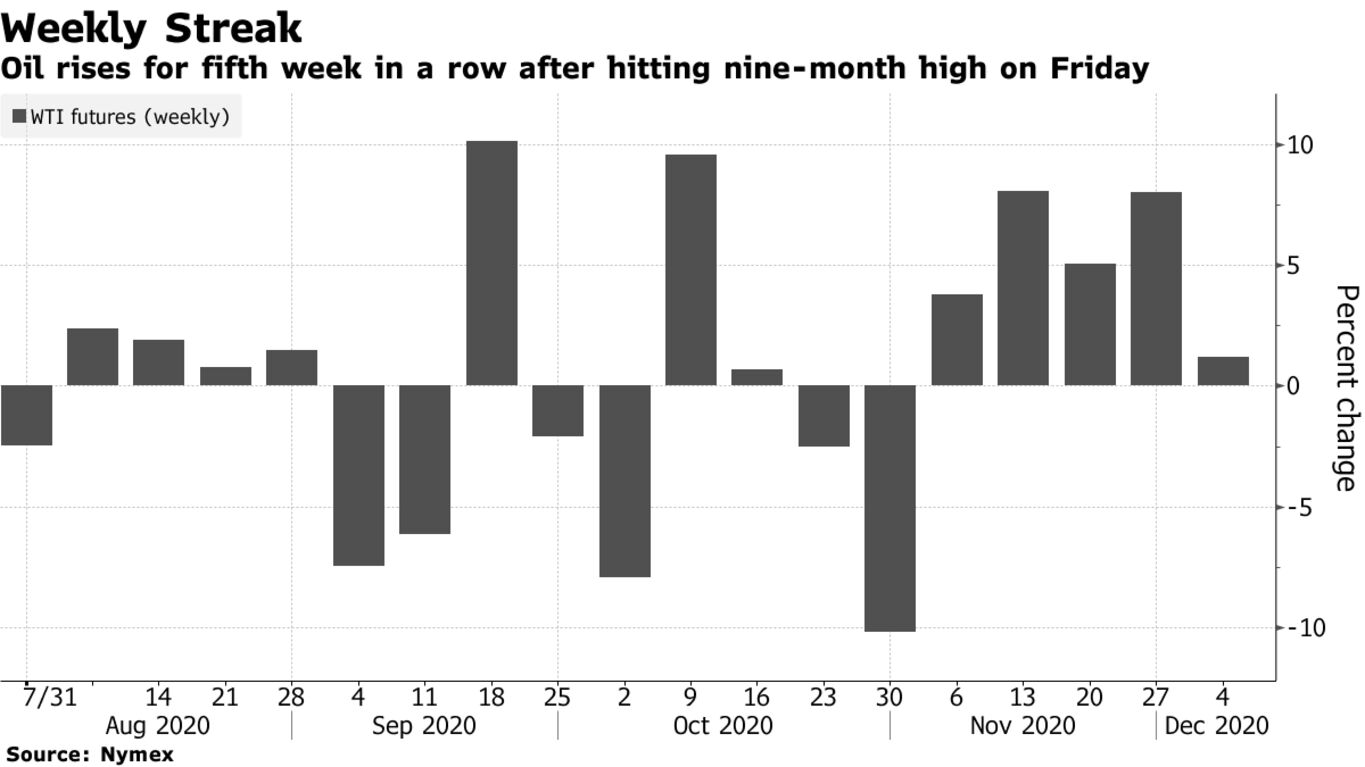

Oil rose for a fifth straight week with support from an OPEC+ deal and hopes for another round of U.S. stimulus. Futures in New York and London closed at fresh nine-month highs on Friday, with signs that momentum is building toward a fiscal stimulus plan that could provide an immediate demand boost, before a vaccine is widely available.

Prices had already been rising after OPEC+ reached a compromise agreement that offers something for members concerned about the fragility of the market, as well as nations who want to pump more to take advantage of higher prices. The agreement involves adding 500,000 barrels a day of production to the market next month, then hold monthly meetings to decide on subsequent moves.

Oil has recently reached the highest levels since March amid optimism over an impending vaccine rollout lifting demand next year. Alongside the rally in headline crude prices, the oil futures curve is signaling tighter supply as demand in Asia booms and the key North Sea market strengthens. The prompt timespread for Brent crude moved back into backwardation this week, while the nearest December contract is trading at a higher level than the same contract for December 2022.

| PRICES |

|---|

|