Oil pushed higher with support from a weakening dollar as investors weighed a worsening short-term demand outlook against an eventual rebound as Covid-19 vaccines are rolled out. Futures in New York rose past $48 a barrel, though liquidity was thin in the period between Christmas and New Year. A dip in the dollar boosted the appeal of commodities such as oil that are priced in the currency. Crude was also aided by broader market strength, with equities heading for a record following U.S. President Donald Trump’s signing of a $900 billion virus-relief package.

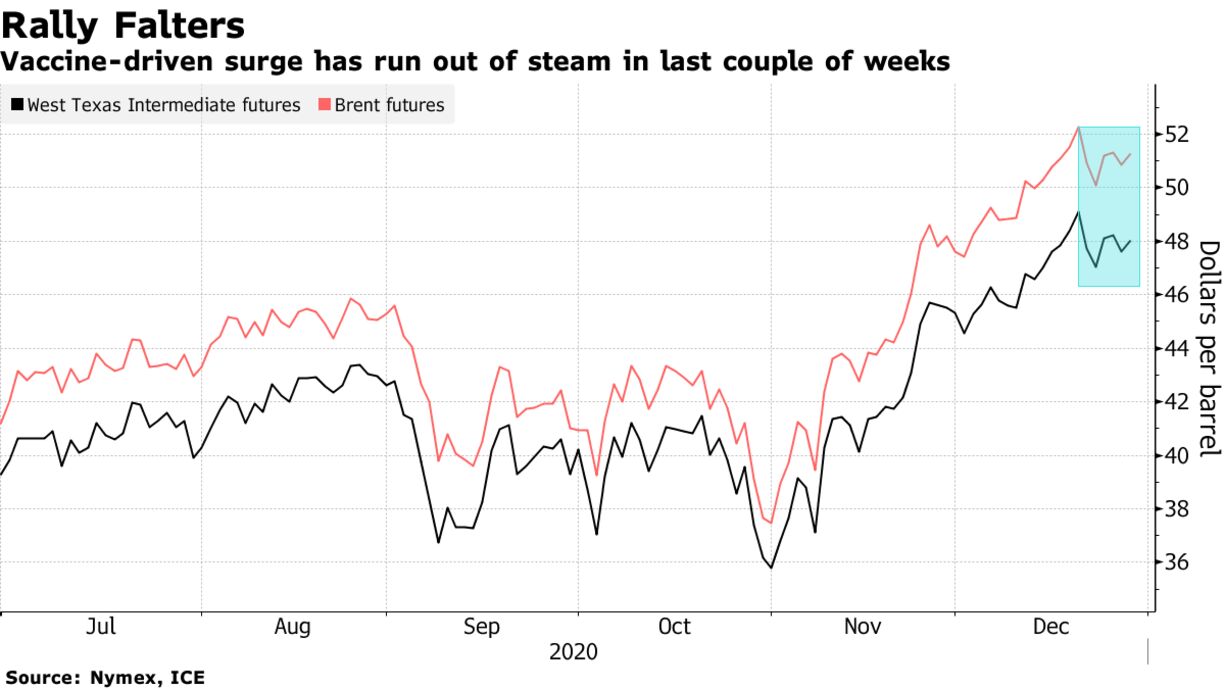

Crude’s vaccine-driven rally has faltered in the past couple of weeks on signs it may have gotten ahead of the recovery in energy demand. The OPEC+ alliance is also set to add another 500,000 barrels a day of output to the market from January, while Russia’s deputy prime minister has said the nation would support a further gradual increase in production in February.

| PRICES |

|---|

|