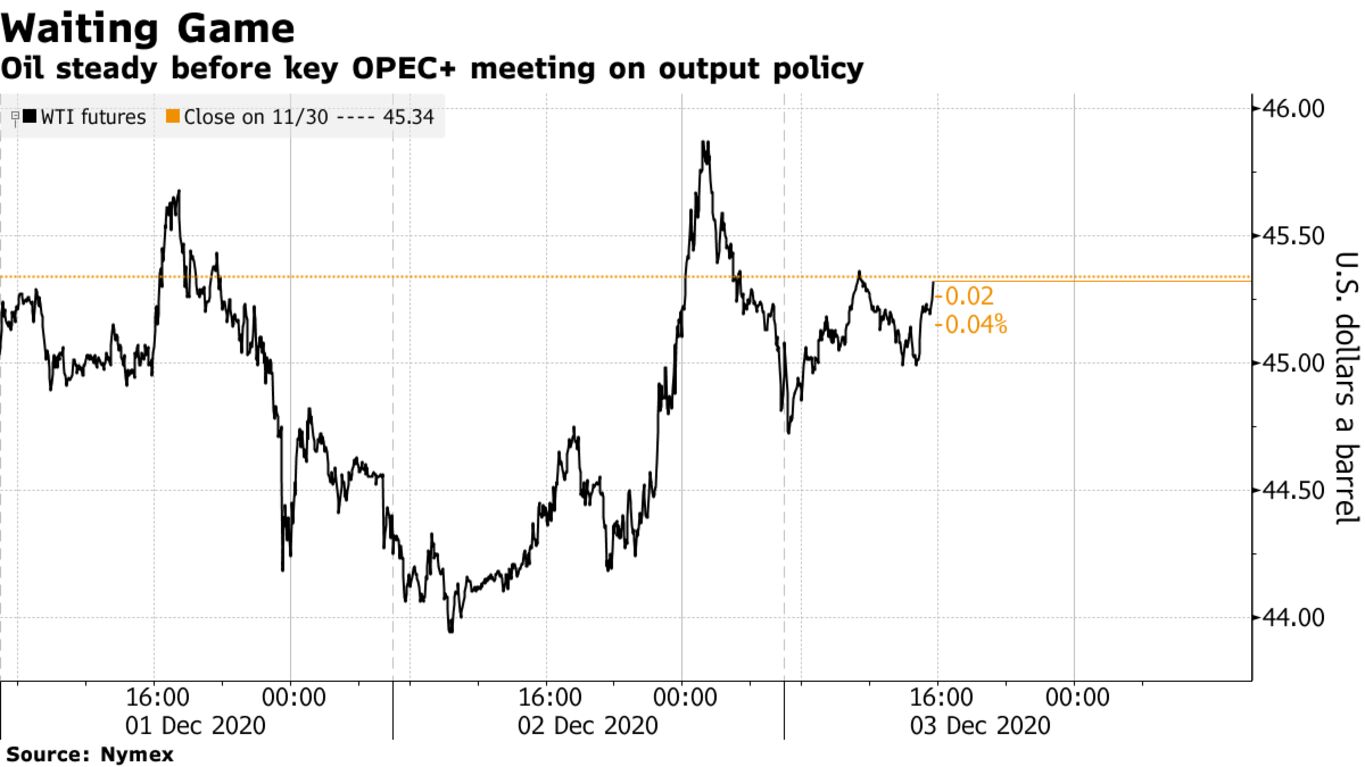

Oil fell before an OPEC+ meeting as powerbrokers in the alliance haggle over output policy after failed talks earlier in the week. Futures in New York traded near $45 a barrel. Discussions are now focusing on proposals for a gradual easing of production cuts over several months, following talks between Russia, Saudi Arabia and the United Arab Emirates, said a delegate. There could be a one-month delay before the tapering starts, according to one delegate, though the Kremlin said it was too early to comment on any deal.

A potential increase in supply could risk a pullback in prices, Citigroup analysts including Francesco Martoccia wrote in a report. The market had been expecting a three-to-six month extension, they said. Talks had initially centered on keeping cuts a further three months, but that option ran into obstacles amid a clash between Saudi Arabia and the UAE.

“Plans to start tapering at the start of the year may trigger a bit of a sell-off as worries over the market tipping into oversupply are currently mostly focused on the winter months,” said Vandana Hari, founder of Vanda Insights in Singapore. Prices had built in some premium on expectations that OPEC+ wouldn’t start adding more barrels to the market next month, she added.

| PRICES |

|---|

|