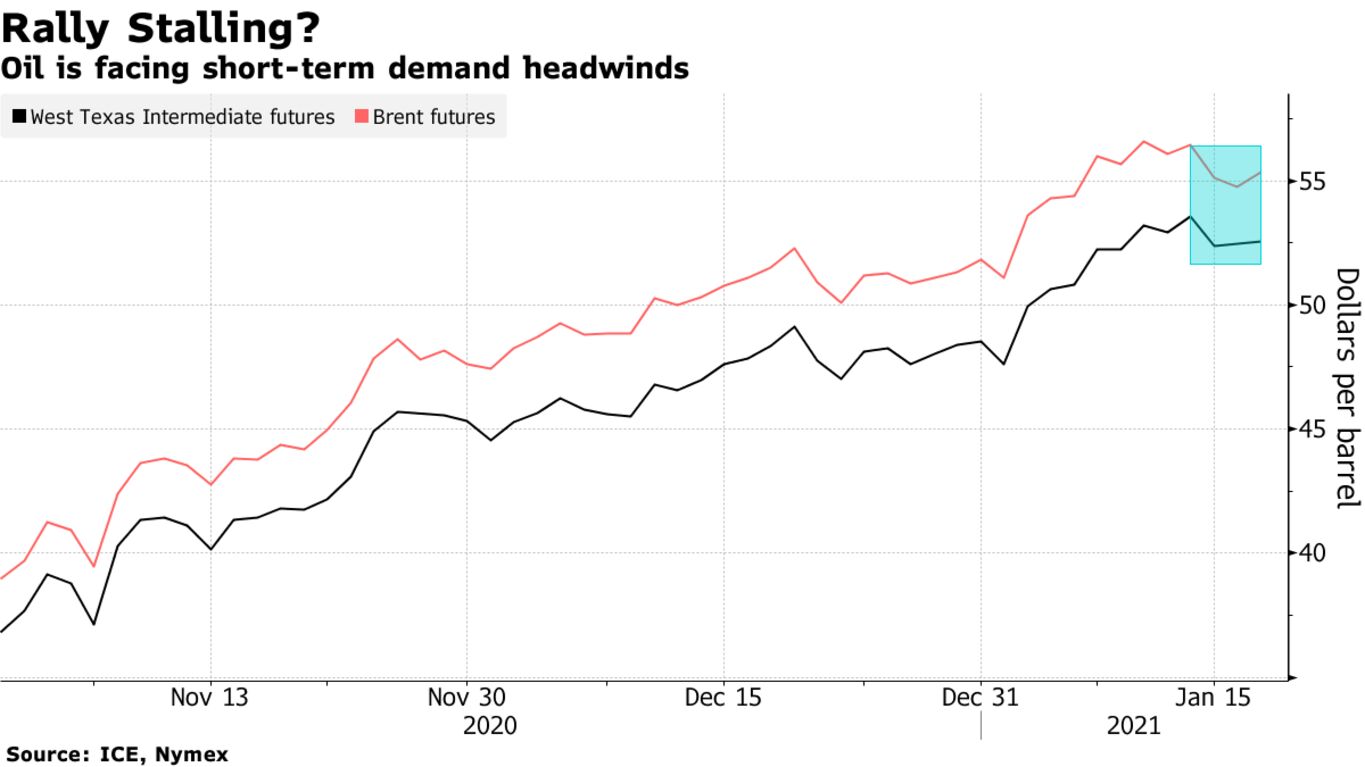

Brent oil rose past $55 a barrel — with some assistance from a weaker dollar — even as the International Energy Agency cut its demand outlook for the rest of the year. Consumption in the first quarter of 2021 will be 600,000 barrels a day lower than previously thought, the agency said as the coronavirus outbreak continues to impede people’s movements. In China, there are government calls for citizens not to travel over the Lunar New Year holidays, stoking concern that Asian demand will take a near-term hit, while vast swathes of Japan are in a state of emergency and several European nations are still locked down.

After a scorching start to 2021 as Saudi Arabia announced unilateral output cuts, oil’s rally has run out of steam over the past few sessions as more virus lockdowns and travel restrictions sap short-term demand. Weakening physical crude prices in Asia have added some headwinds, but the outlook for later in the year is still strong with expectations that coronavirus vaccines will see movement start to increase again.

“We are still bullish even though our forecasted balance has weakened somewhat,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “Accelerating demand, only gradually reviving U.S. shale supply and restrained supply from OPEC+ should be a good backdrop for prices.”

| PRICES: |

|---|

|