The economic distress of the Covid-19 pandemic is picking up where it left off at the end of 2020. The latest high-frequency data show activity in the advanced economies softened in the first two weeks of the new year. In the U.S., government figures showed retail sales fell for a third month in December as a resurgent virus prompted another tightening of business restrictions. Europe is facing the possibility that output will shrink in consecutive quarters. Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

U.S.

Tightening Belts

U.S. retail sales fell 0.7% in December after previous month revised lower

Source: U.S. Commerce Department

Retail sales declined at the close of the holiday-shopping season, wrapping up a painful year for the nation’s merchants as the pandemic forced store closures and kept consumers at home. The value of receipts for all of 2020 rose just 0.6%, the weakest performance in 11 years.

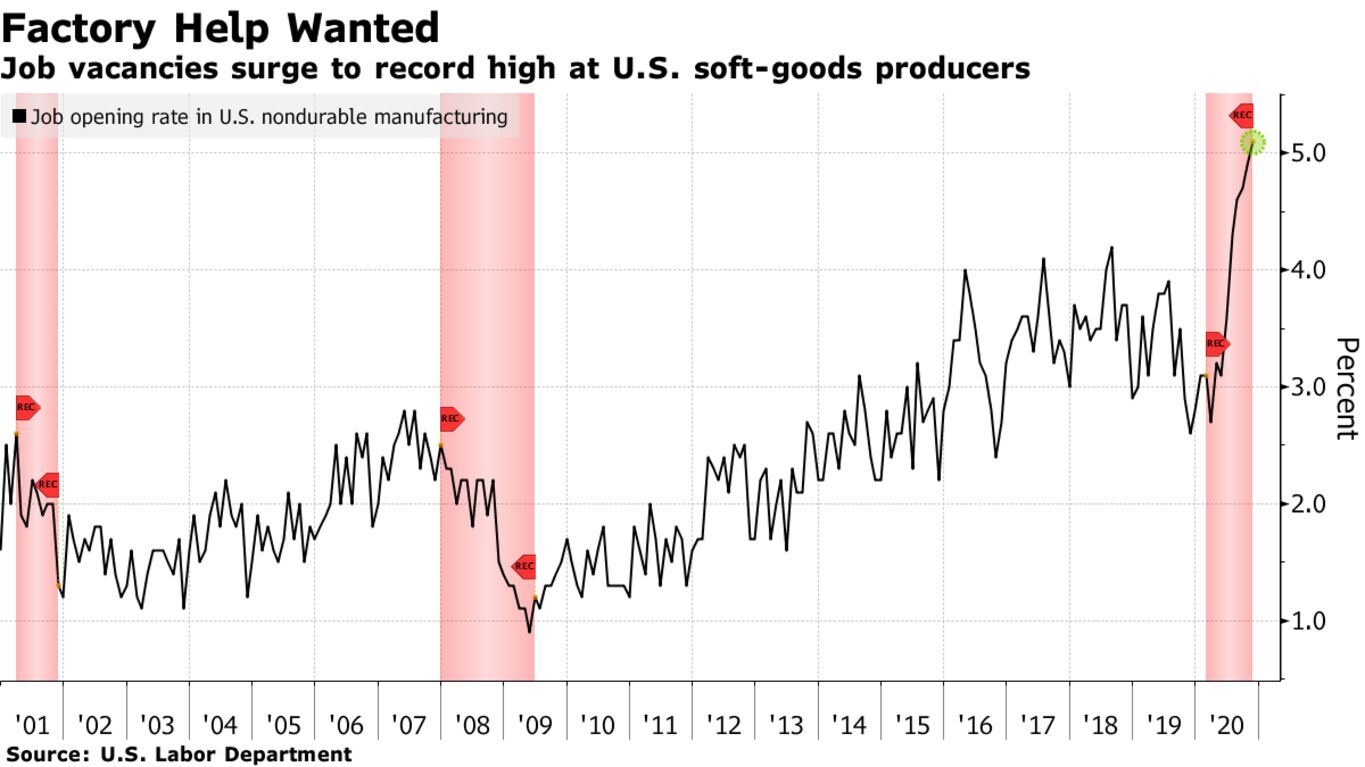

Meanwhile, the U.S. factory sector continues to show promise. The rate of job openings, or number of available positions as a share of total employment in the non-durable goods industry plus the vacancies, hit 5.1% in November, the fifth straight record in data back to 2000.

Europe

Euro-Area Pain

Bloomberg Economics sees economy contracting 4.1% in first quarter

Source: Bloomberg Economics estimates and forecasts

Note: Monthly Index, January 2020 = 100

Under pessimistic assumptions on the duration of new lockdown restrictions to contain the spread of Covid-19, Bloomberg Economics lowered its first-quarter estimate for the euro-area economy to a 4.1% contraction, after a 1.5% drop in the final three months of 2020.

Leaving Britain

The U.K.’s eastern European population shrank almost 200,000 last year

Source: Office for National Statitics

Note: EU14 = members before 2004; EU8 = countries that joined in 2004; EU2 = Bulgaria and Romania, which joined in 2007. Data for year to June since 2016

The number of eastern Europeans living in the U.K. last year slumped to levels last seen in 2015 ahead of the end of the Brexit transition and as the coronavirus lockdowns closed huge parts of the economy.

Asia

Full Steam Ahead

China’s share of the global economy is expected to grow at a faster pace

Source: IMF, World Bank, McKinsey & Company

China’s economic ascent is accelerating barely a year after its first coronavirus lockdowns, as its success in controlling Covid-19 allows it to boost its share of global trade and investment.

Emerging Markets

A Mexican Woman’s Work

Number of hours per week spent on household chores has fallen more for men than women*

Source: Use of Time survey of the National Institute of Statistics and Geography of Mexico

*Average hours per week spent on cooking, cleaning and caring for children, elderly or disabled

The women of Mexico already faced the worst economic prospects in Latin America. Now the pandemic threatens to sink them even further, aggravating chronic inequality and dragging down the country’s fortunes.

World

Weak Start

Activity in advanced economies is significantly lower than a month ago

Source: Bloomberg Economics, Google, Moovitapp.com, German Statistical Office, BloombergNEF, Indeed.com, Shoppertrak.com, Opportunity Insights

Note: Jan. 8, 2020 = 100

After the holiday slump, activity in several of the world’s largest advanced economies extended their recovery in the second week of January. Yet compared with early December, Bloomberg Economics gauges that integrate data such as mobility, energy consumption and public transport usage remain significantly lower.

America First

U.S. seen as most attractive business location among G-7

Source: Stiftung Familienunternehmen

The U.K. dropped behind the U.S. as the best international business location for the first time since the ranking was created by Germany’s Foundation for Family Businesses in 2006. Even so, it’s still ahead of other Group-of-Seven countries, with Italy at the bottom of the list.