Oil declined as a slide across financial markets overshadowed the positive signal from the biggest draw in U.S. crude stockpiles in six months. Futures in New York slid 0.4% as negative sentiment rippled through markets amid concerns over earnings, the resurgence of the pandemic, and a cautionary outlook on the U.S. economy from the Federal Reserve. A stronger dollar also reduced the appeal of commodities priced in the U.S. currency. The bearish tone eclipsed an almost 10 million-barrel decline in American crude stockpiles and shrinking inventories at the key storage hub of Cushing.

There are also signs that the Covid-19 outbreak is continuing to crimp fuel consumption. China’s flight and road travel has declined ahead of the Lunar New Year, which typically sees a seasonal boost to fuel consumption, while traffic in Los Angeles slumped over the past month.

“The initial euphoria sparked by the inventory data has quickly evaporated,” said Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt. “The tone in the oil market is more pessimistic again.”

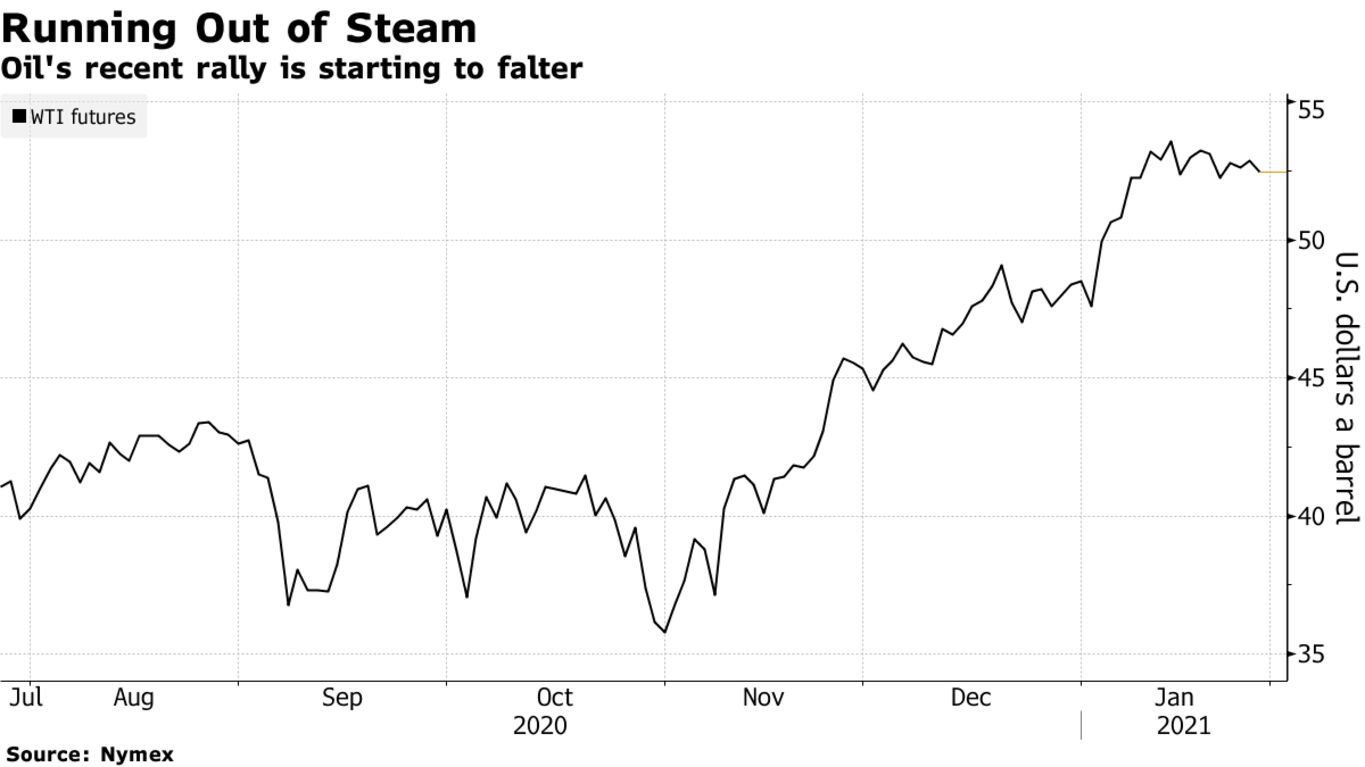

Oil has surged almost 50% since the end of October but the rally has faltered as a resurgent virus leads to more restrictions in some countries. Still, strict production curbs by OPEC and its partners could supersede the drag on demand and send Brent crude past $70 a barrel by the end of this year, according to JPMorgan Chase & Co.

| PRICES |

|---|

|