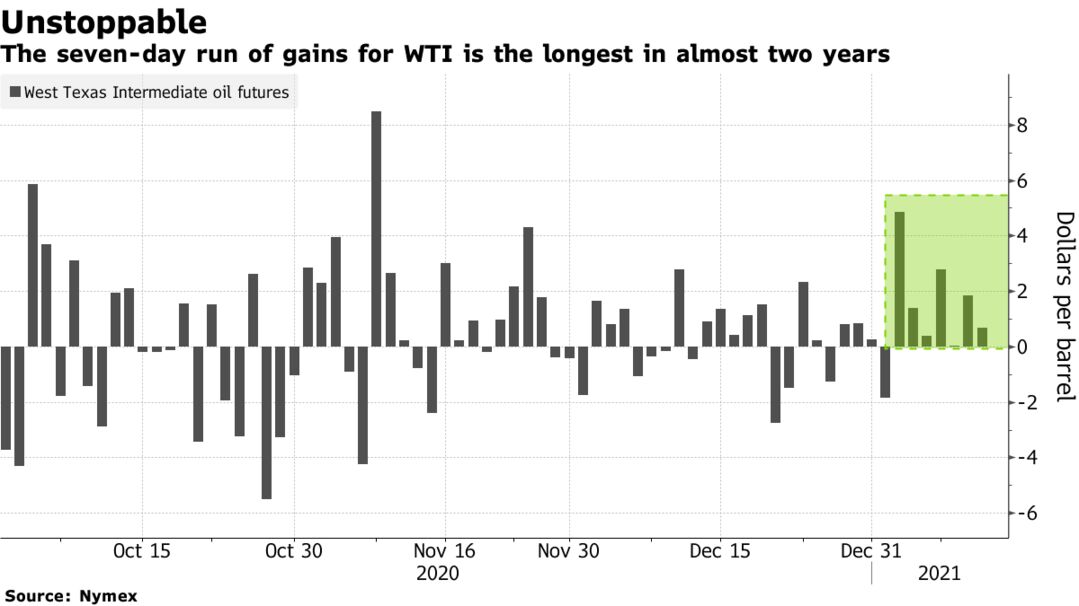

Oil crept higher after an industry report pointing to another decrease in U.S. crude stockpiles, which added impetus to a new year rally driven by Saudi Arabia’s output cuts. Futures in New York pared some earlier gains, but were still on track for their longest rising streak in almost two years on a tighter supply outlook. The American Petroleum Institute reported crude inventories dropped by 5.82 million barrels last week, according to people familiar with the figures. Saudi Arabia, meanwhile, trimmed February supply to at least 11 refiners in Asia and Europe after announcing surprise production curbs last week.

Covid-19 vaccine breakthroughs and the recent Saudi pledge to deepen cuts have underpinned a meteoric rise for oil since the end of October, with prices up almost 50%. There are still concerns about global fuel demand as the virus continues to spread in some regions. Japan expanded its state of emergency and an outbreak in China appears to be worsening.

“Prices are up again as traders are still weighing the consequence of a tighter oil market from February,” said Bjornar Tonhaugen, head of oil markets at Rystad Energy AS. “Normally, having such strict lockdowns in Europe and a rise in infections in the U.S. and China, the market should be worrying.”

| PRICES |

|---|

|