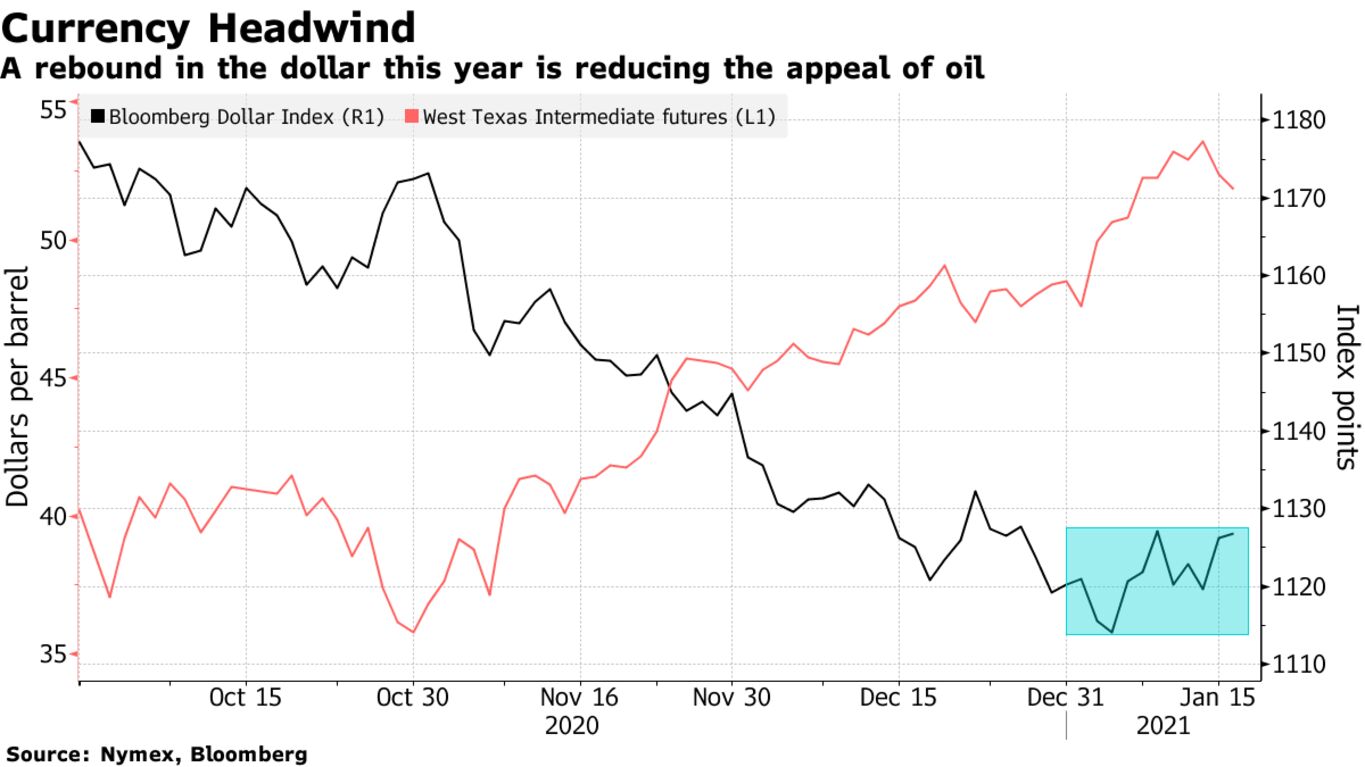

Oil edged lower in Asia as a stronger dollar and a still-surging coronavirus outweighed Chinese economic data that beat estimates. Futures in New York fell toward $52 a barrel after closing down 2.3% on Friday. The dollar kept rising, reducing the appeal of commodities like oil that are priced in the currency. The U.S. is on track to reach 400,000 deaths from Covid-19 before President-elect Joe Biden’s inauguration on Wednesday, while the U.K. is shutting its borders to anyone who hasn’t tested negative.

Oil managed to eke out a small gain last week, but the rally that started in early November and has pushed prices to the highest in almost a year is stalling amid a worsening short-term demand outlook. Biden is planning a $1.9 trillion virus relief package, which may give oil another tailwind if it passes.

Biden’s inauguration will be the focus of markets this week, particularly on how quickly he can roll out his fiscal stimulus plans,” said Howie Lee, an economist at Oversea-Chinese Banking Corp. The dip in prices on Friday was a “breather” for a market that has risen strongly this year, he said.

| PRICES |

|---|

|