Oil erased most of its gains as futures traded in tandem with broader markets, with demand concerns prevailing over the biggest drop in U.S. crude supplies since last summer. While futures in New York closed 0.5% higher on Wednesday, a weaker U.S. equity market ultimately pushed the benchmark down in after-market trading. A meaningful recovery in demand still appears to be a ways off. In the latest example of the pandemic’s boomerang effect in fuel markets, traffic in Los Angeles dropped sharply this past month after stricter stay-at-home measures were enforced in California, while consumption in China also weakened.

“There’s still a lot of concerns on the demand side and that contributes to stanching these rallies,” said Andrew Lebow, senior partner at Commodity Research Group. The Chinese government “is urging its citizens not to travel in what is the busiest travel time of the year. Clearly, that’s going to have an impact on demand.”

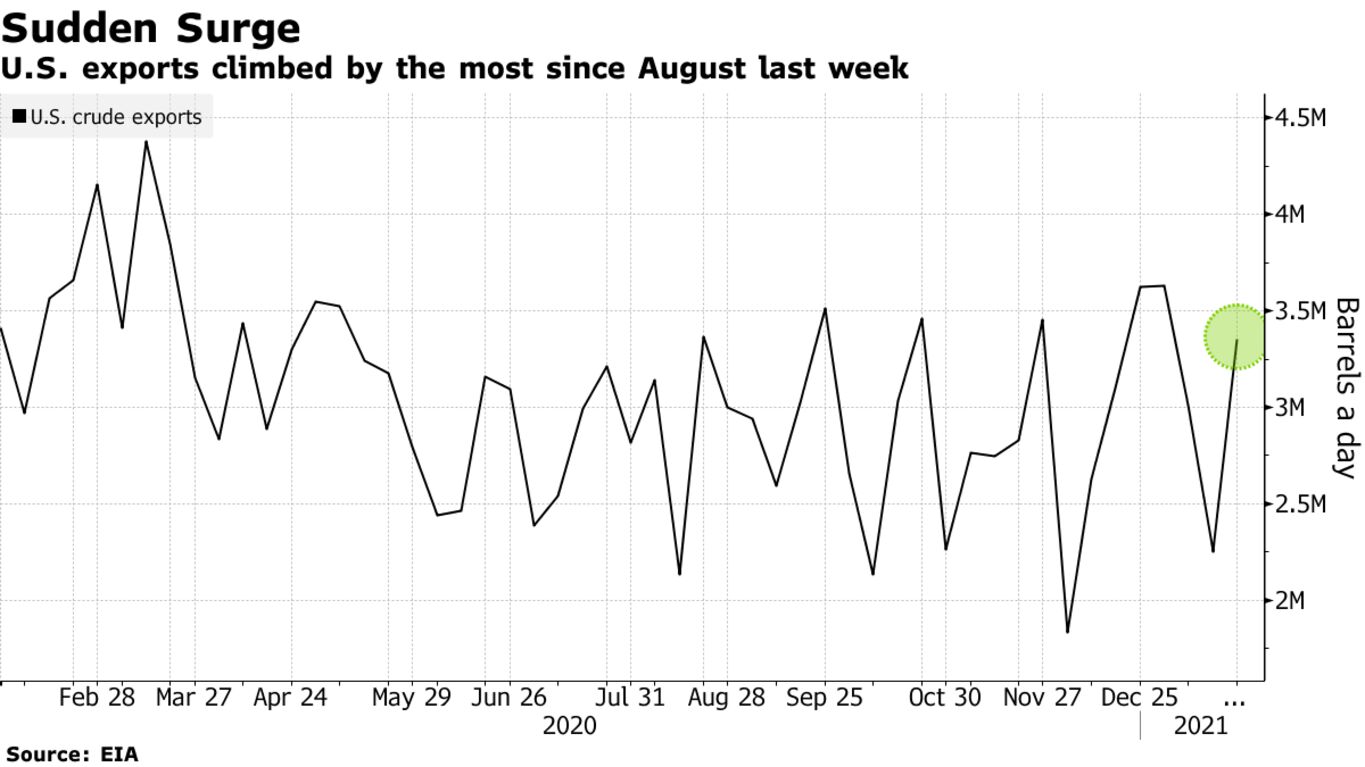

Earlier in the session, a U.S. government report showed domestic crude inventories dropped by nearly 10 million barrels last week and exports surged.

The rise in U.S. exports is a “signal that global demand continues to improve and is likely stronger than here in the U.S., at least for now,” said Rob Thummel, a portfolio manager at Tortoise, a firm that manages roughly $8 billion in energy-related assets.

| PRICES |

|---|

|