Oil in New York climbed as the dollar declined, with the market assessing the potential for more supply after the International Energy Agency said a “big chunk” of U.S. shale is profitable at current prices. Futures rose 0.9% toward $53 a barrel as a weaker dollar increased the appeal of commodities like oil that are priced in the currency. Many producers will be able to boost output and U.S. shale will be needed to fill the gap in the oil balance in the short term, IEA Director Fatih Birol said during a Bloomberg television interview. American crude stockpiles, however, remain at the highest seasonal level in decades after Covid-19 crushed demand.

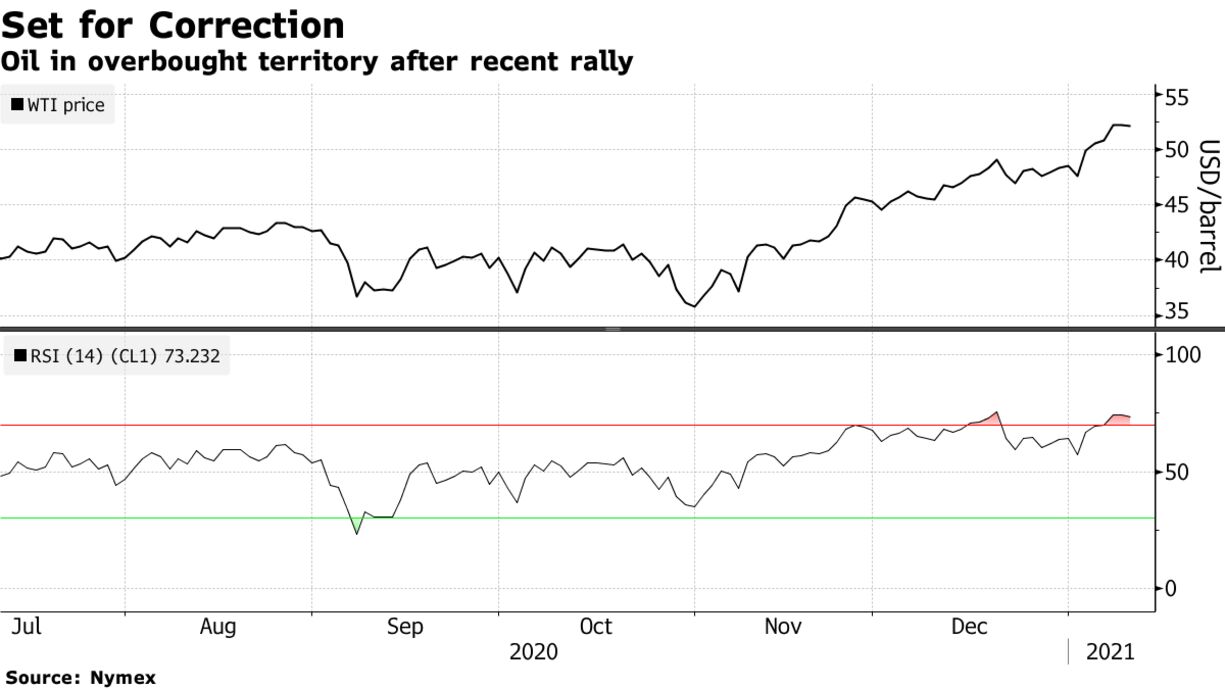

Oil has surged more than 45% since the end of October after Covid-19 vaccine breakthroughs, with Saudi Arabia’s pledge to deepen output cuts over the next two months adding impetus to the rally. The rollout of coronavirus shots is still expected to take some time and the spreading outbreak is raising concerns a sustained rebound in demand won’t take place until later in the year.

| PRICES |

|---|

|