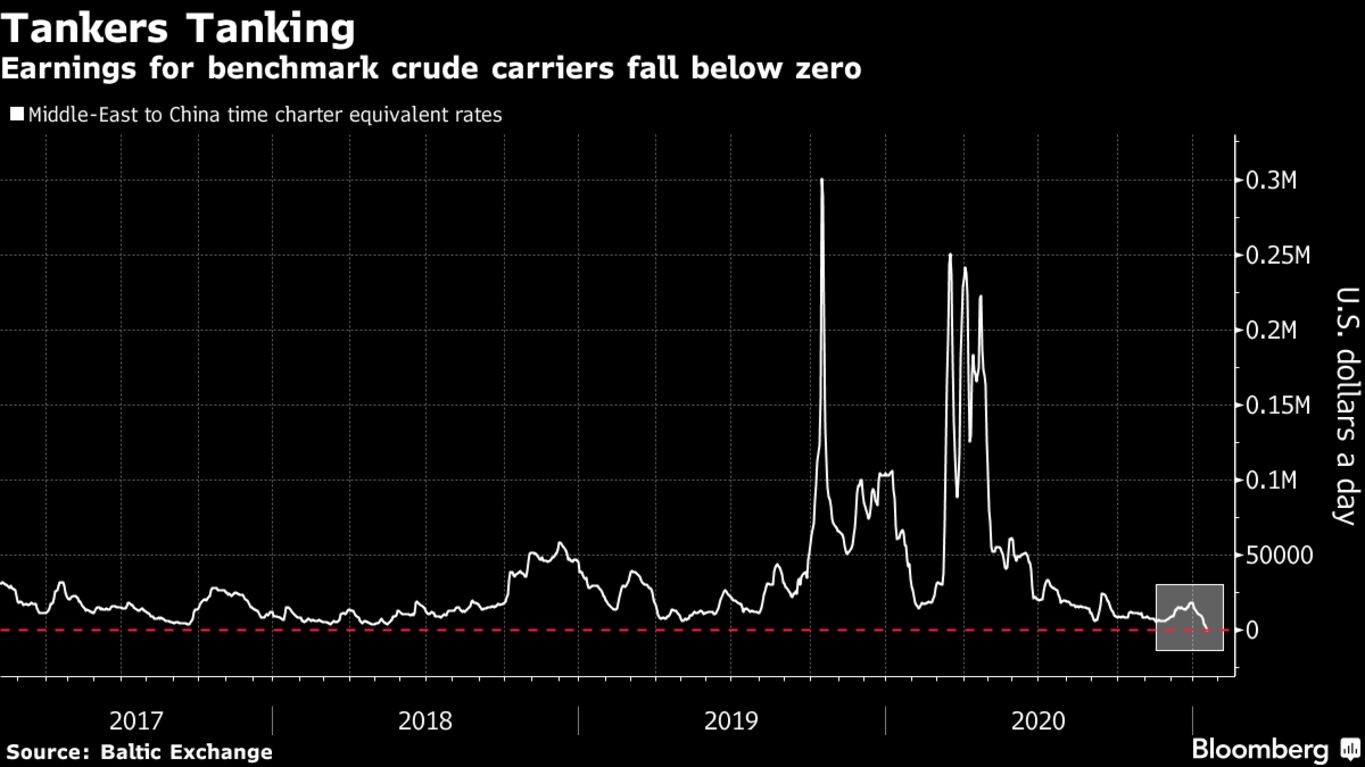

Saudi Arabia’s oil production cuts have hit the tanker market so hard that the biggest vessels in the market are effectively subsidizing cargo deliveries on the industry’s main trade route. Supertankers delivering 2 million barrel cargoes of the kingdom’s oil to China are losing $736 a day for the privilege, according to data from the Baltic Exchange in London on Tuesday. While owners might, in practice, be able to mitigate such losses by ordering captains to sail the vessels slower, the reality is that some ships are losing money on Middle East-to-Asia deliveries, according to Halvor Ellefsen, a shipbroker at Fearnleys.

“Even the most economical ships out there are struggling to get positive numbers,” he said. “It’s carnage right now.”

While tanker rates weren’t particularly strong up to the end of last year, they weren’t disastrous either. What really seems to have tipped the balance is when Saudi Arabia, wary of oil demand risks posed by Covid-19, announced that it would unilaterally cut 1 million barrels a day of production to support crude prices. That removed a big chunk of seaborne shipments in a market where cargoes were already curtailed.

Traders also reported lower demand over the past few days from some buyers in Asia where refineries will soon start carrying out seasonal maintenance programs and therefore need fewer crude cargoes.

Seeking Approvals

While negative earnings may look illogical, owners might be tempted to operate ships at a loss because there are still costs involved in keeping a ship at anchor — so they could lose money anyway. Vessels that spend too long without moving cargoes also risk losing much-prized approvals, whereby oil companies deem the ships fit for charter. Approvals can take time to secure.

Negative earnings can arise when the fees that oil companies pay to charter ships don’t cover the costs involved. At that point, owners either have to reject the bookings or pay some of the ship’s fuel bills. As a result of the slump, analysts are expecting to see the tanker fleet begin to slow down when ships return, sailing in ballast, from having delivered cargoes.

“Earnings estimates are now sensitive to speed assumption,” said Clarksons Platou analysts including Frode Moerkedal. “Although we cannot see it in the average data yet, vessel speed on the empty return voyage form the Far East should go down.”