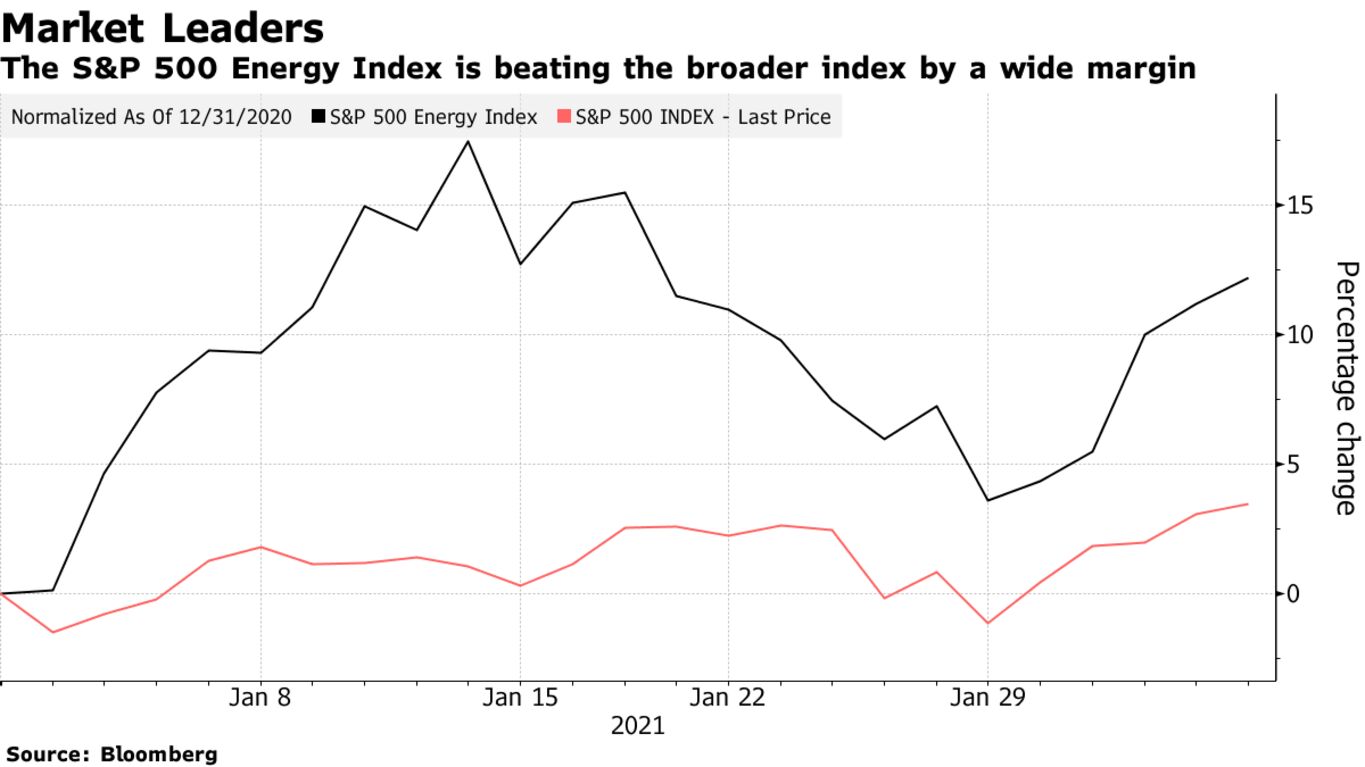

U.S. oil and gas stocks, by far the worst performers last year, are standing out as the best in 2021 — a turnaround that might seem a bit surprising given the new balance of power in Washington. Companies including Exxon Mobil Corp., Diamondback Energy Inc. and Marathon Oil Corp. have posted double-digit gains this year as a rebound in oil prices and the prospect of an economic recovery have outweighed risks to the industry from a Joe Biden administration. The S&P 500 Energy Index is up 12% this year compared to 2020’s 37% plunge.

However, Wall Street is now assessing whether those gains are sustainable as Democrats commit to speeding the shift away from fossil fuels. Companies that extract gas and oil from shale rock using a process known as fracking are already under pressure to reduce spending rather than invest in production. Any additional regulatory measures could be received poorly by investors.

So far Biden has made good on a campaign promise to cancel the Keystone XL oil pipeline and issued a moratorium on new oil and gas leasing on federal lands. While such moves can be a short-term boon for crude prices by restraining supply, they mark what is likely to be a strong pivot in energy policy away from hydrocarbons.

The bull case for oil majors will hinge on self-help measures that increase investor interest as shareholders continue to pressure the group to show greater austerity and return profits rather than use the money to boost production.

“I have a hard time seeing the need for U.S. producers over the next several years to get back to double-digit growth,” Devon Energy Corp. Chief Executive Officer Rick Muncrief said in a recent interview. “For this management team, if we really think about 2021, let’s keep it flat.”