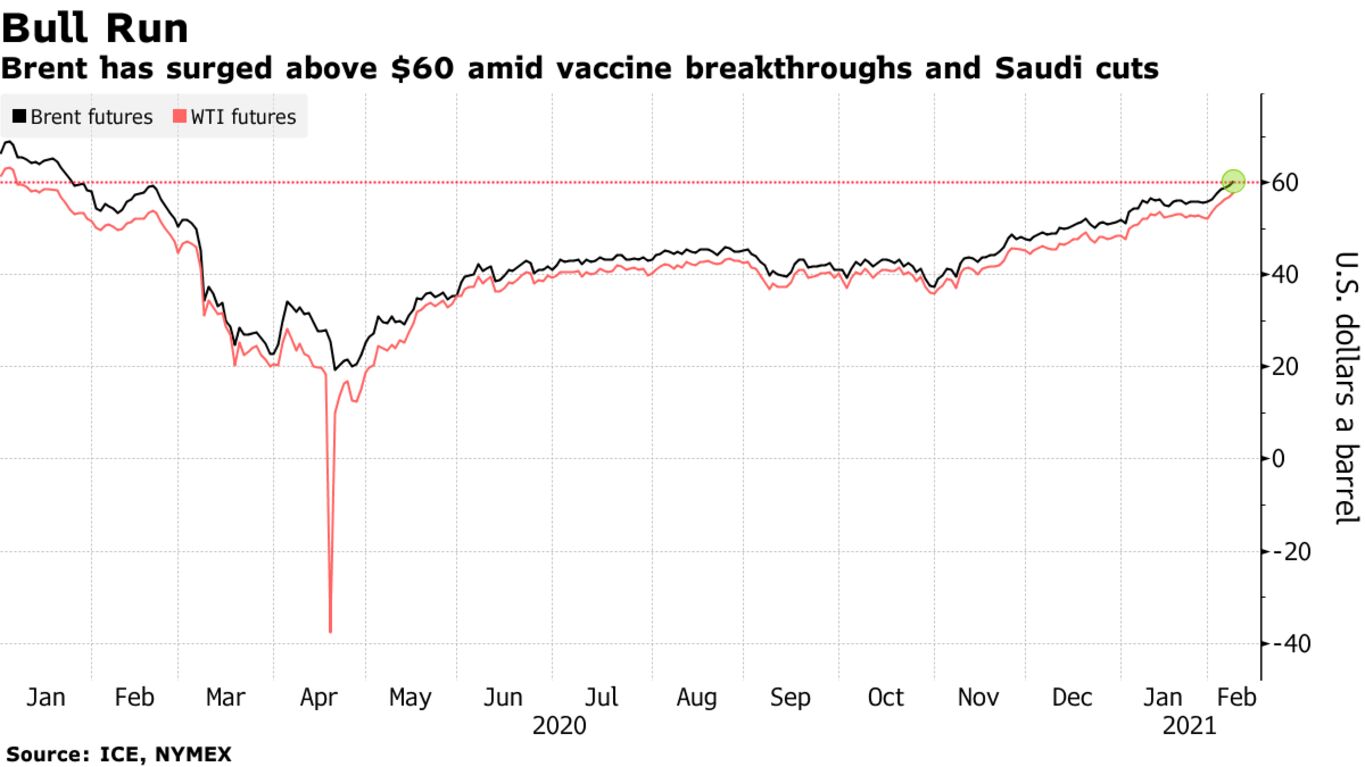

Oil in London rose above $60 a barrel for the first time in more than a year in a rally that’s dividing the world’s top oil trading houses. Global benchmark Brent futures surged 2.1% on Monday. Surpassing the key marker is another milestone in a stellar comeback from the depths of the pandemic, which forced countries to lock down and devastated economies. Trading house Trafigura Group sees prices moving even higher as refiners increase processing rates to meet rising product demand amid tight physical crude supplies.

However, with a full-fledged demand recovery yet to take shape, futures may have rallied too far too fast, especially with key technical indicators signaling crude is in overbought territory. The world’s largest independent oil trader, Vitol SA, and rival Gunvor Group Ltd. both expressed caution over the recent rally.

Helping buttress oil’s recovery has been a historical production cut agreement by OPEC+: Global stockpiles in onshore tanks and floating storage are estimated by the International Energy Agency to have shrunk by about 300 million barrels since the group made deep reductions in May. Meanwhile, reduced supply and a Covid-19 vaccine-driven demand boost have entrenched the oil futures price curve in a bullish backwardation structure, which encourages more draining of oil tanks.

China has been a key driver of the market rebound. The number of tankers sailing toward the nation jumped to a six-month high on Friday. Royal Dutch Shell Plc Chief Executive Officer Ben van Beurden said last week that fuel sales in China are back into “significant growth mode.” Meanwhile, Indian demand is almost back to year-ago levels as consumption of cooking fuels and gasoline surged on the back of forced lifestyle changes due to the virus.

Saudi Arabia’s production cut “gives people a lot more confidence in OPEC+’s ability to manage supply,” said Peter McNally, global head for industrials, materials and energy at Third Bridge. “OECD inventories have been drawing, and it looks like they’re going to continue to head lower with OPEC steering the ship.”

| PRICES |

|---|

|