Oil held gains in New York after rising above $60 a barrel for the first time in a year as a deepening energy crisis in the U.S. disrupted crude production and forced the shutdown of some of the nation’s biggest refineries. As much as 1.7 million barrels a day of oil output has halted and deliveries via pipeline suspended as freezing weather cripples Texas’s power system and blackouts spread to other states in the central U.S. Energy Aspects Ltd. said 3 million barrels a day of processing capacity could be off-line.

“There are some tailwinds behind oil prices at the moment,” said Fiona Boal, Head of Commodities and Real Assets at S&P Dow Jones Indices LLC. “We will continue to see these spurts of either very cold or very hot weather that can have drastic and immediate impact on supply, but they don’t tend to be very long-lasting.”

The crisis is just the latest in a series of cold snaps in the northern hemisphere that have boosted oil consumption this year.

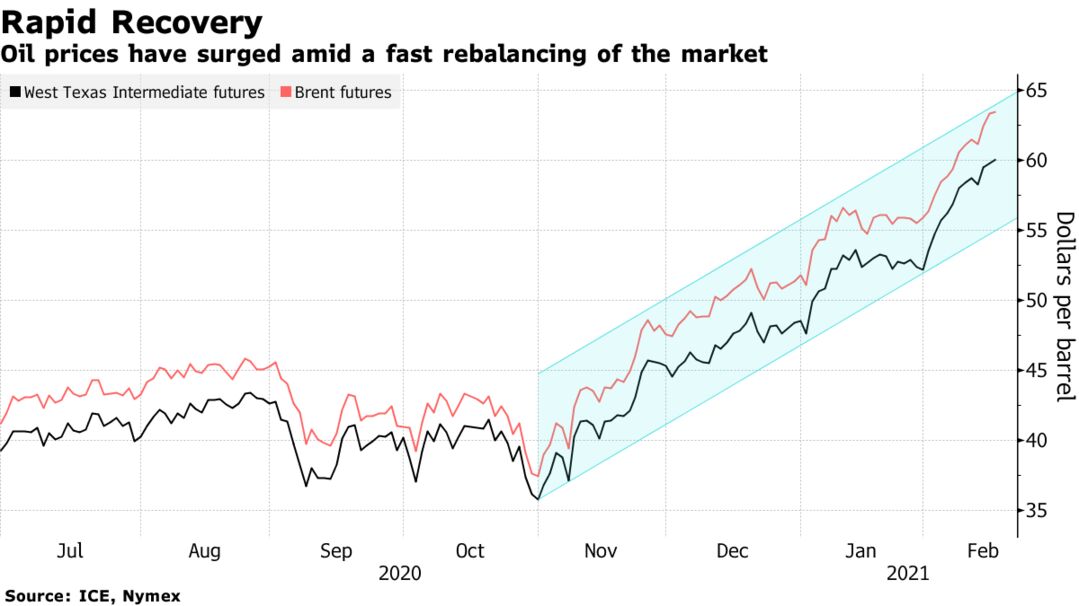

Saudi Arabia’s unilateral output cuts have helped the global crude benchmark rally more than 20% this year as swollen global stockpiles are drawn down even as a stubbornly persistent coronavirus leads to more lockdowns.

| PRICES |

|---|

|