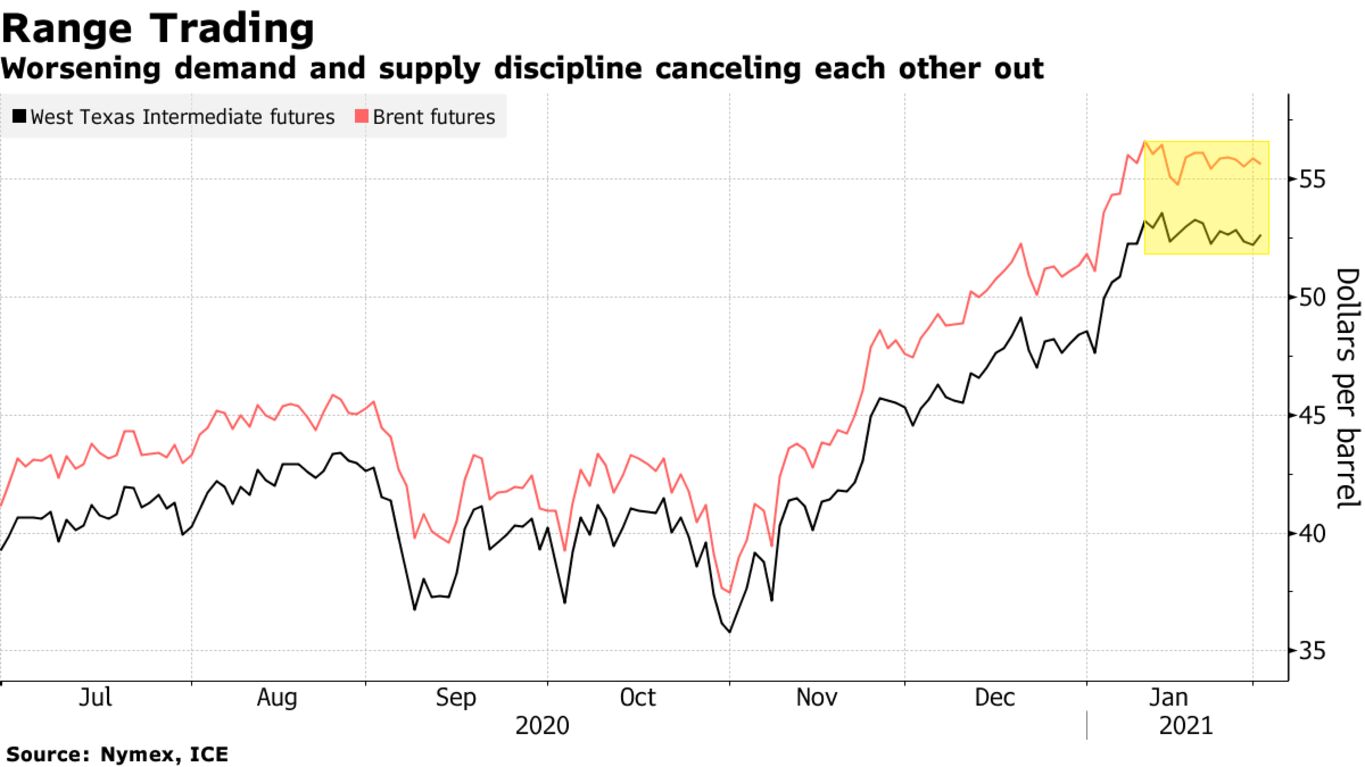

Oil climbed toward $53 a barrel — after the first back-to-back weekly declines since October — as investors weighed continued supply discipline from producers against a worsening short-term demand outlook. OPEC and its allies estimated they implemented 99% of their agreed oil-supply curbs in January, according to a delegate who asked not to be named. Chevron Corp. said it will wait until it has a firmer read on the trajectory of the pandemic and OPEC+ before resuming its plan to increase shale output. India’s government pledged to stick with higher spending as it released its annual budget, which will aid energy demand in the third-biggest oil importer.

A Chinese purchasing managers’ index for manufacturing missed estimates for January, showing that efforts to rein in Covid-19 are starting to affect Asia’s largest economy. Meanwhile. a top health adviser to President Joe Biden said Sunday that a new variant of the virus circulating in the U.K. will likely become the dominant strain in the U.S. and may lead to curbs on in-person gatherings.

The demand outlook, offset by tight supply and a surge of investment in commodities, has seen crude trade near $52 a barrel over the past couple of weeks. The European Union’s botched vaccine rollout is causing consternation among investors, while in Israel — where 30% of people have been vaccinated — the emergence of more infectious variants is overwhelming hospitals.

| PRICES |

|---|

|