Oil soared toward $55 a barrel in New York, touching its highest level in a year as the virus-recovery rally continued. West Texas Intermediate futures rose 2.4%, while the global Brent benchmark came back within sight of $60. Gains in broader markets spurred crude, while a weaker U.S. dollar also buoyed commodities priced in the currency. Oil has risen steadily since late last year as coronavirus vaccines and supply curbs from OPEC and its allies spur hopes that global stockpiles will continue to slide.

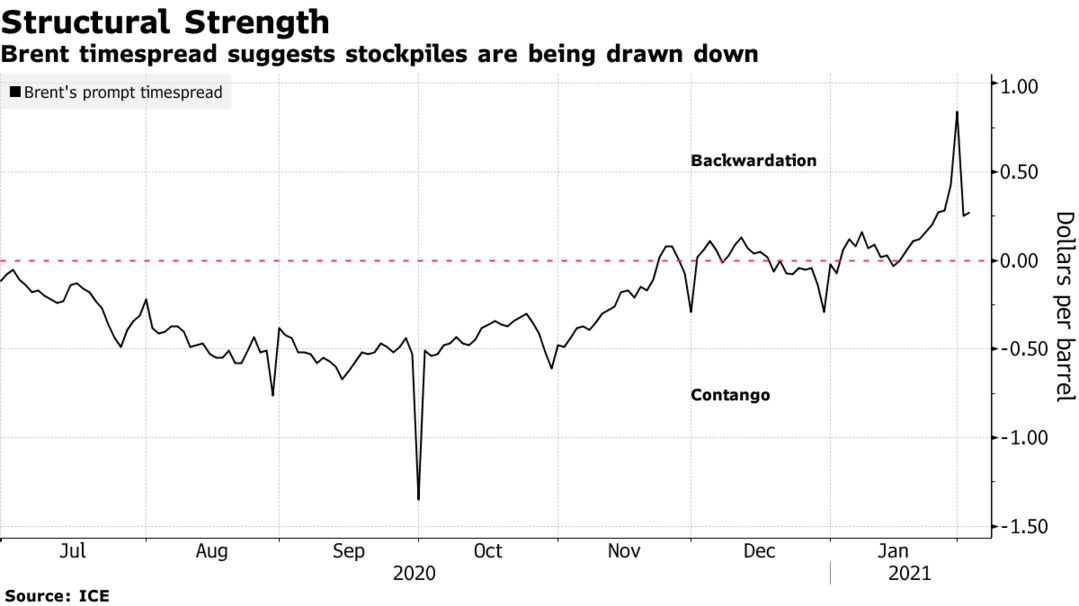

Alongside that move, the structure of the futures curve has been firming, adding to the bullish outlook. Nearby Brent time spreads are trading in their biggest backwardation in a year, suggesting supply tightness.

Oil still faces bumpy short-term demand amid concern that new virus variants will lead to more lockdowns, while vaccine rollouts are slower than expected in some countries. Still, with cold weather sweeping across the U.S. and much of Wall Street anticipating inventory draws in the coming months, prices continue to surge higher.

| PRICES |

|---|

|