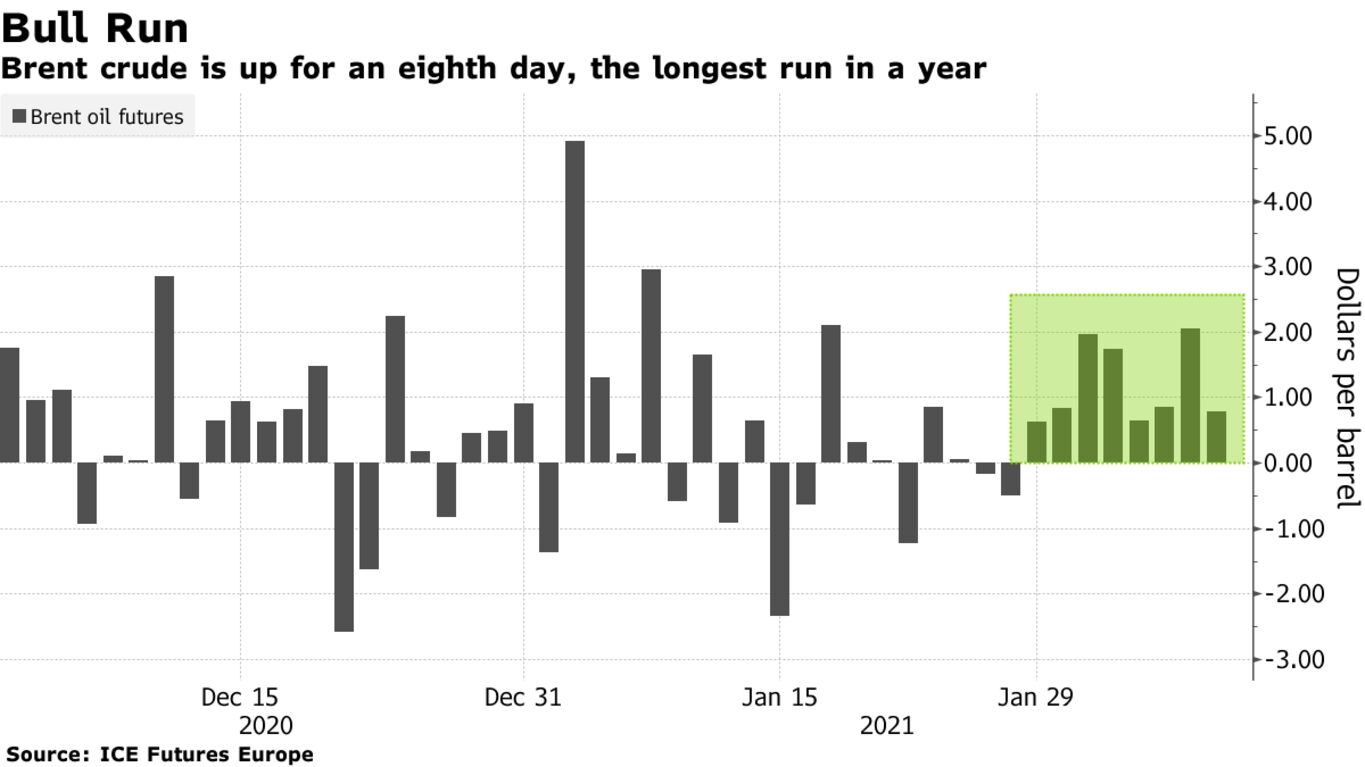

Oil extended a rally from the highest level in more than a year on signs the global market is tightening and demand is improving. Futures in London climbed above $61 a barrel after surging 9% over the past seven sessions as oil continued a robust recovery from the Covid-19 pandemic that eviscerated fuel demand. Trafigura Group sees prices moving even higher as refiners increase processing rates to meet rising product demand, while crude stockpiles in the U.S. are forecast to have dropped further last week.

Key prompt timespreads for global benchmark Brent and U.S. crude are in a bullish backwardation structure and firming, making it unattractive to hoard oil on ships and helping to unwind global stockpiles built up during the outbreak.

Oil’s surge since the end of October has been underpinned by Covid-19 vaccine breakthroughs and a more recent pledge by Saudi Arabia to deepen production cuts. Slowing coronavirus infections across the globe is raising optimism fuel consumption will continue to climb, although there are signs the recovery will be uneven in the near-term as some regions grapple with the spreading virus.

“Fundamentally, we are seeing the pace of tightening picking up, with the additional Saudi cuts in effect,” said Warren Patterson, head of commodities strategy at ING Bank NV. “We are at levels where we should see quite a bit of producer hedging taking place, which should start to provide some resistance.”

| PRICES |

|---|

|