Oil surged as traders and investment banks see global supplies rapidly tightening in response to a vaccination-led recovery this summer. Futures in London jumped 3.7% on Monday, its largest daily gain since early January, as a range of bullish calls and upward revisions to price forecasts boosted optimism over oil demand. Goldman Sachs Group Inc. sees Brent reaching $75 a barrel as consumption continues to recover faster than supply from OPEC+ and shale. Meanwhile, Morgan Stanley also boosted estimates as it sees oil heading for what may be the tightest quarter since at least 2000.

The loss of crude production from the unprecedented polar blast in the U.S. will help further firm oil markets heading into the summer as much of the world emerges from lockdowns, Trafigura Group’s co-head of oil trading Ben Luckock said in a Bloomberg Television interview. Some 40 million barrels of February oil output, largely from the Permian Basin, will not be produced due to the freeze, Luckock said.

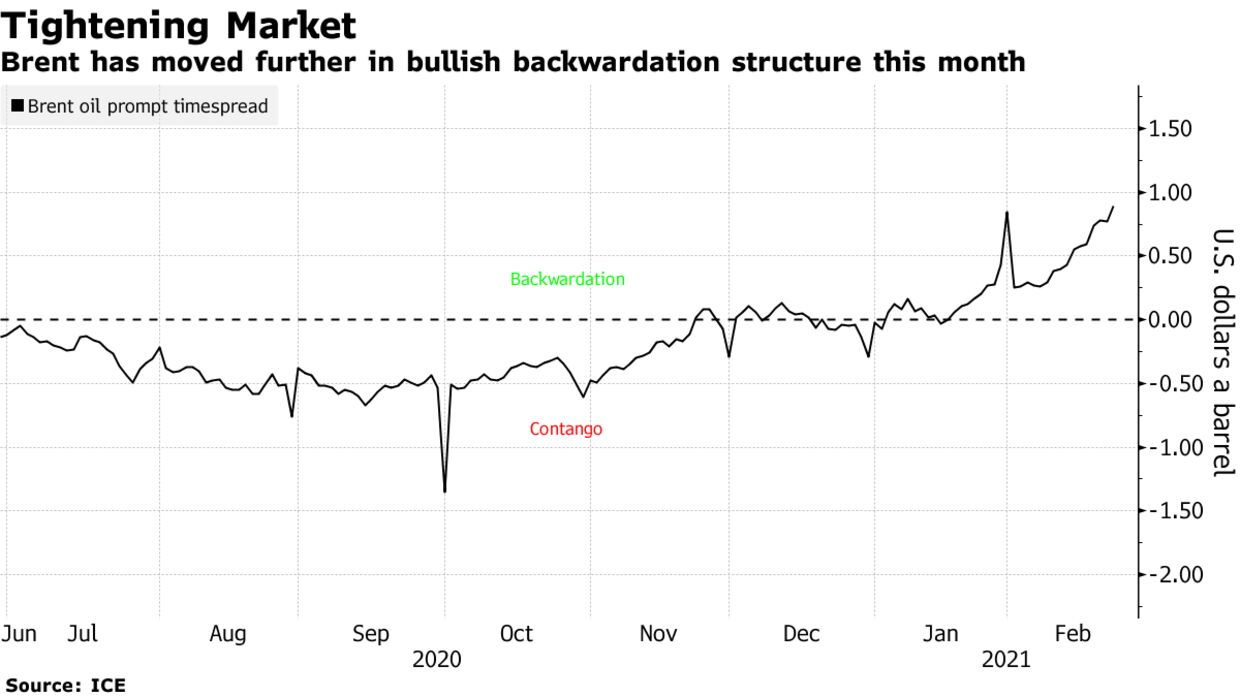

Global benchmark crude has gained over 25% this year after a January pledge from Saudi Arabia to deepen production curbs turbocharged a rally triggered by Covid-19 vaccine breakthroughs. Brent’s prompt timespread has firmed in a bullish backwardation structure, signaling a tighter market and helping to unwind global stockpiles built up during the pandemic. Crude oil stored at sea fell to an 11-month low last week, according to Vortexa, in another sign of dwindling supplies.

| PRICES |

|---|

|