India’s record pump prices of gasoline and diesel are the newest threat to the economy’s nascent recovery, as high local taxes on retail fuel risk fanning inflation and driving a wedge between the objectives of fiscal and monetary policy makers. Gasoline prices were at an all-time high of 97.6 rupees ($1.3) a liter in Mumbai Tuesday, while diesel — the bellwether of industrial activity — sold for a record 88.6 rupees, data from state-run Indian Oil Corp. show. Taxes make up more than half of that cost and represent a sore point for the inflation-targeting Reserve Bank of India, which has vowed to keep borrowing costs low for as long as needed to support economic growth.

“Persistently higher prices could lead to a generalized inflationary environment, making it difficult for the RBI to hold on to its growth commitment,” said Priyanka Kishore, chief India and South-east Asia economist at Oxford Economics in Singapore. “Rising fuel taxes, alongside the pick-up in global oil prices, could threaten India’s recovery.”

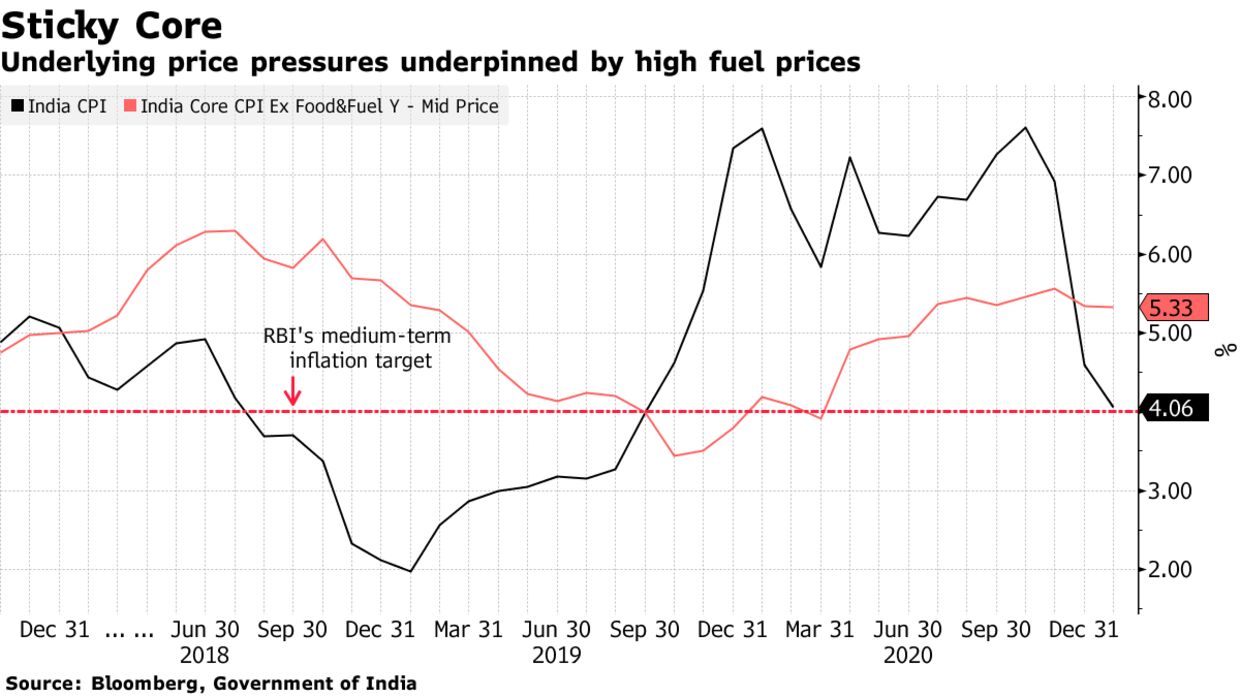

While revenue gains from taxes on retail fuel are key for Prime Minister Narendra Modi and India’s states to boost spending in the economy that exited a rare recession last quarter, the RBI sees those levies, along with elevated crude prices, already pushing core inflation higher. Any withdrawal of the easy monetary policy to combat price-growth will lead to a spike in borrowing costs, in turn hurting consumption and business activity at a time when millions of Indians are still out of work due to the pandemic.

“Enabling a calibrated unwinding of high indirect taxes on petrol and diesel – in a co-ordinated manner by centre and states – are critical to contain further build-up of cost-pressures in the economy,” Governor Shaktikanta Das said, according to the minutes of the latest monetary policy meeting.

Fuel taxes now make up nearly a fifth of New Delhi’s gross tax revenues, up from less than 10% nearly six years ago, according to calculations by economists at ICICI Securities and Primary Dealership.

While consumer price inflation is within the RBI’s 2%-6% target range for now, economists see the second round effects of higher pump prices on transportation and manufacturing sectors soon feeding into the headline print.