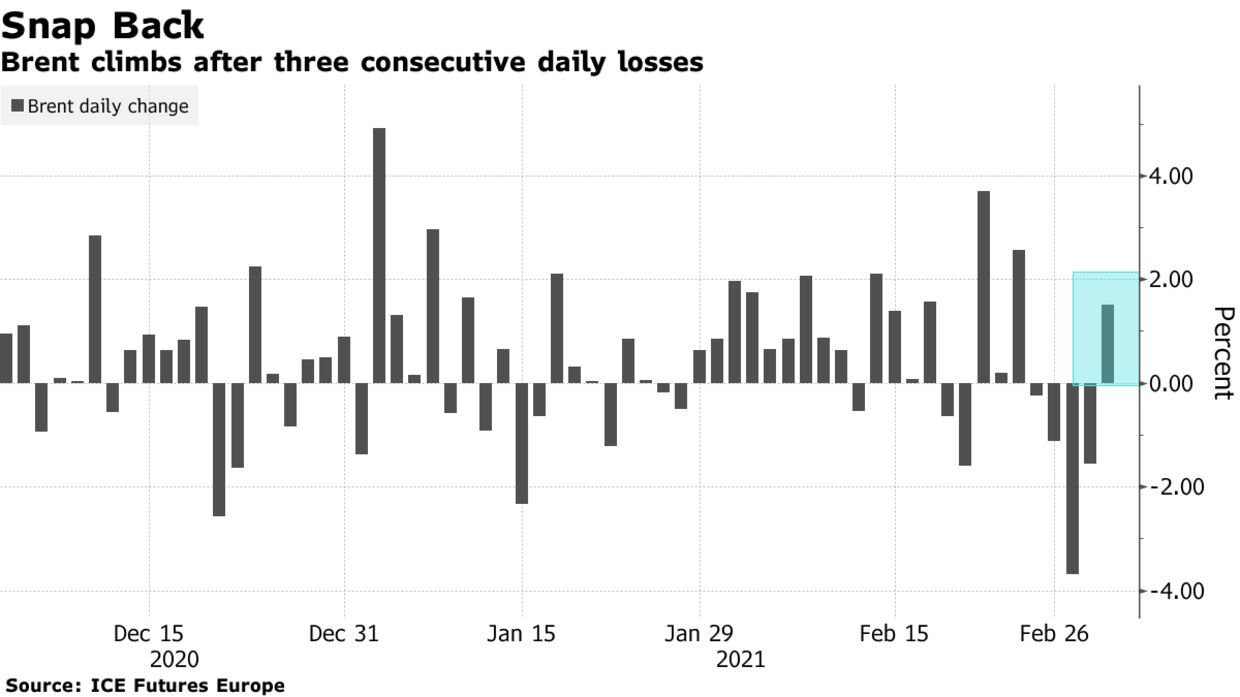

Oil climbed ahead of a crucial OPEC+ meeting, as the alliance was expected to agree a coordinated increase in output as the pandemic’s impact on the market recedes. Brent futures rose 1.5% after three consecutive days of losses for the first time since December. The widespread view among the Organization of Petroleum Exporting Countries and its allies is that the oil market can absorb extra barrels, according to people familiar with the matter.

Oil has staged a powerful rally this year, driven by significant OPEC+ curbs — including unilateral cuts by Saudi Arabia — and a vaccine-aided rebound in demand. That strength has paved the way for the alliance to unleash some barrels, with OPEC Secretary-General Mohammad Barkindo saying on Tuesday that both the wider economic outlook and oil-market fundamentals continue to improve. The group could return the bulk of the 1.5 million barrel-a-day hike that’s up for debate.

| PRICES: |

|---|

|

The gathering pace of recovery presents “the perfect opportunity for OPEC+ to raise production,” Australia & New Zealand Banking Group Ltd. said in a note, predicting that the group will agree to add 750,000 barrels per day.