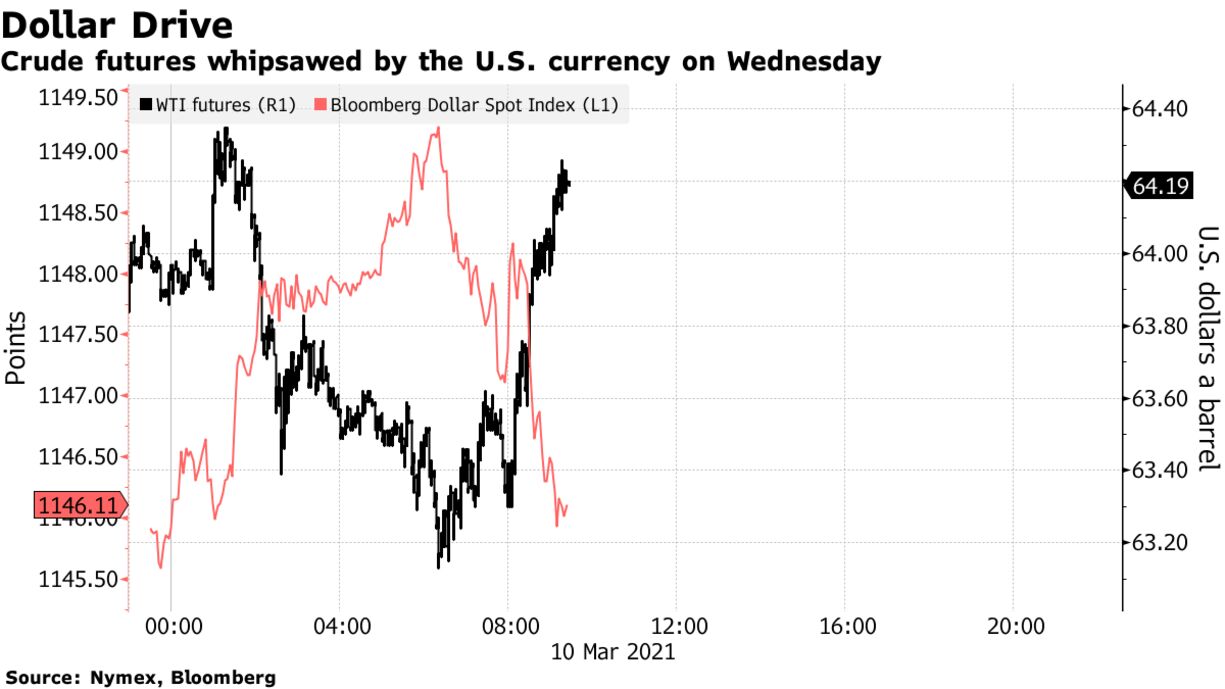

Oil reversed an earlier decline, largely undulating with the swings in the dollar before data on U.S. oil stockpiles due later. Futures in New York edged lower on Wednesday, after falling more than 3% over the past two sessions. Market volatility has also been creeping higher in recent weeks. The American Petroleum Institute reported crude inventories rose last week, while gasoline stockpiles fell, according to people familiar.

Crude is still up more than 30% this year, hitting a multiyear high on Monday as the market tightens. Output cuts from Saudi Arabia and OPEC+, and an improving demand outlook with the rollout of Covid-19 vaccines have both aided the rally. Tensions have also escalated in the Middle East after a key crude export terminal in the kingdom was attacked on Sunday, adding to a recent series of assaults on the major producer.

“Global oil inventories could be back to normal already in May this year,” said Bjarne Schieldrop, chief commodities analyst SEB AB. “OPEC+ is keeping the market much tighter this year than we had expected.”

| PRICES |

|---|

|

There are already signs that oil demand is recovering. An Idled plant in the Philippines will restart in the second half as fuel sales rebound in the Asian nation. Congestion in New York is also clawing back, with this month set to mark the fastest increase in toll route traffic since November 2019.