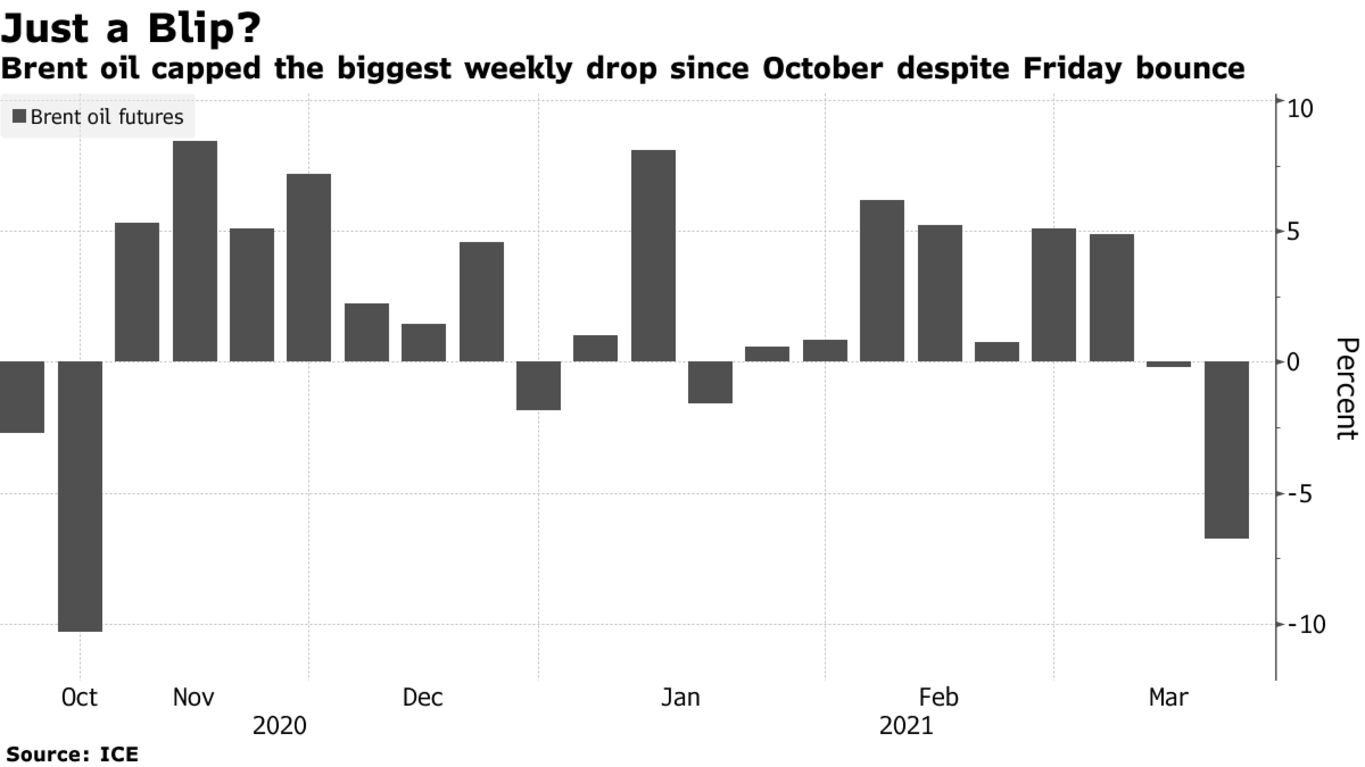

Brent oil gave up some gains posted at the end of the worst week since October as the dollar strengthened and as investors assessed the near-term demand outlook. Futures in London lost 1% to slip below $64 a barrel as a rising dollar reduced the appeal of commodities priced in the U.S. currency. Demand is showing some signs of weakness with the number of unsold April-loading oil cargoes from West Africa swelling, while Germany is proposing an extension to lockdown restrictions. Despite posting a 2% gain on Friday, crude suffered a heavy weekly loss following a bearish start to last week.

Saudi Arabia, meanwhile, saw another assault on its energy facilities. While the offensive by Iran-backed Houthi rebels on an Aramco refinery on Friday had no impact on oil supplies, it’s the latest in a series of attacks on the kingdom.

Despite the weekly plunge, there’s confidence in the long-term outlook and a return to higher prices. Goldman Sachs Group Inc. said the recent sell-off was transient and that the rebalancing would continue with vaccinations driving higher mobility. The market will be keenly watching the OPEC+ meeting next week for any change to its output policy in May, especially after the slide in oil and comments from the International Energy Agency that supply is plentiful.

| PRICES |

|---|

|