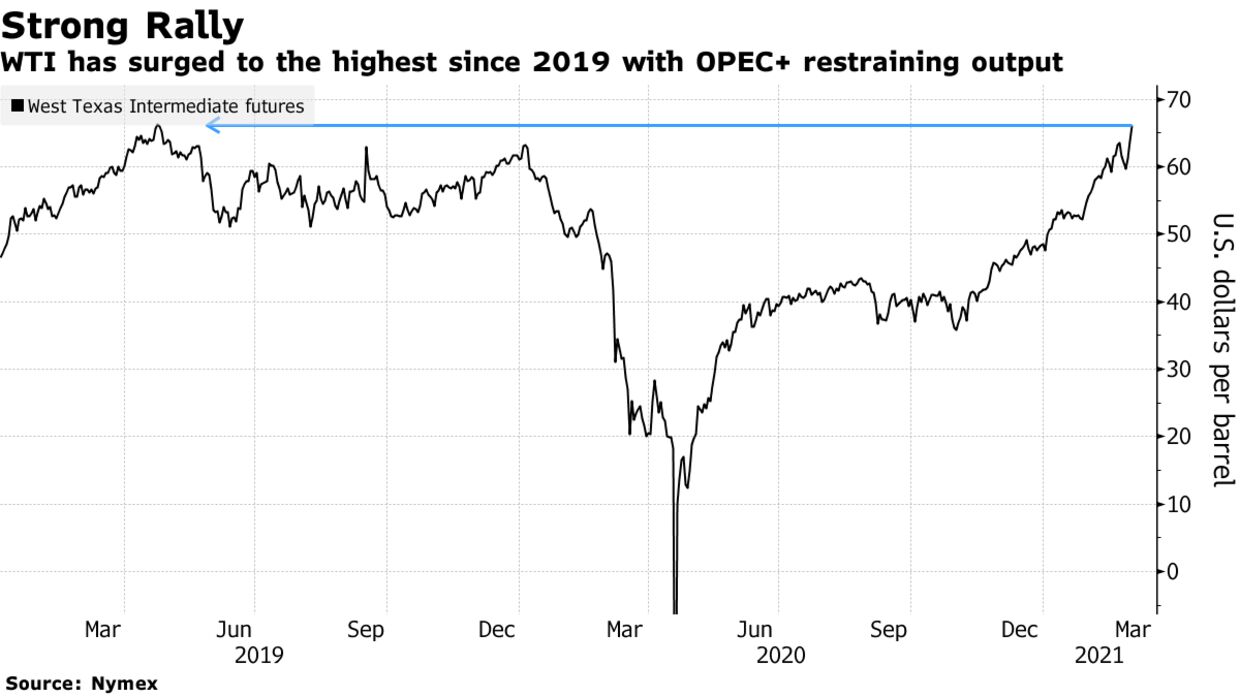

Oil rallied to the highest in nearly two years in New York after OPEC+ shocked markets with a decision to keep supply limited as the global economy starts to recover from a pandemic-driven slump. U.S. benchmark crude futures topped $66 a barrel on Friday, while its global counterpart Brent neared the key $70 level. The producer alliance’s supply curbs and the rollout of Covid-19 vaccines have aided a stellar rebound for crude from the depths of the coronavirus-related fallout. OPEC+’s surprise decision on Thursday to keep output steady in April boosted prices further and led to strength in the market’s structure. Major banks upgraded price forecasts, with some calls for oil reaching north of $100 next year.

“In some ways, even more important than the lack of oil was the message that came with it: They’re not really worried about price, not worried about tightening,” said Paul Horsnell, head of commodities research at Standard Chartered Plc. “The door is wide open to prices beyond $70.”

Crude has soared more than 30% so far this year with OPEC+’s output restraint holding the market over until a full-fledged comeback in consumption. The group’s latest decision represents a victory for Riyadh, which has advocated for tight curbs to keep prices supported.

“Overall, this was the most bullish outcome we could have expected,” JPMorgan Chase & Co. analysts including Natasha Kaneva wrote in a note to clients.

| PRICES: |

|---|

|