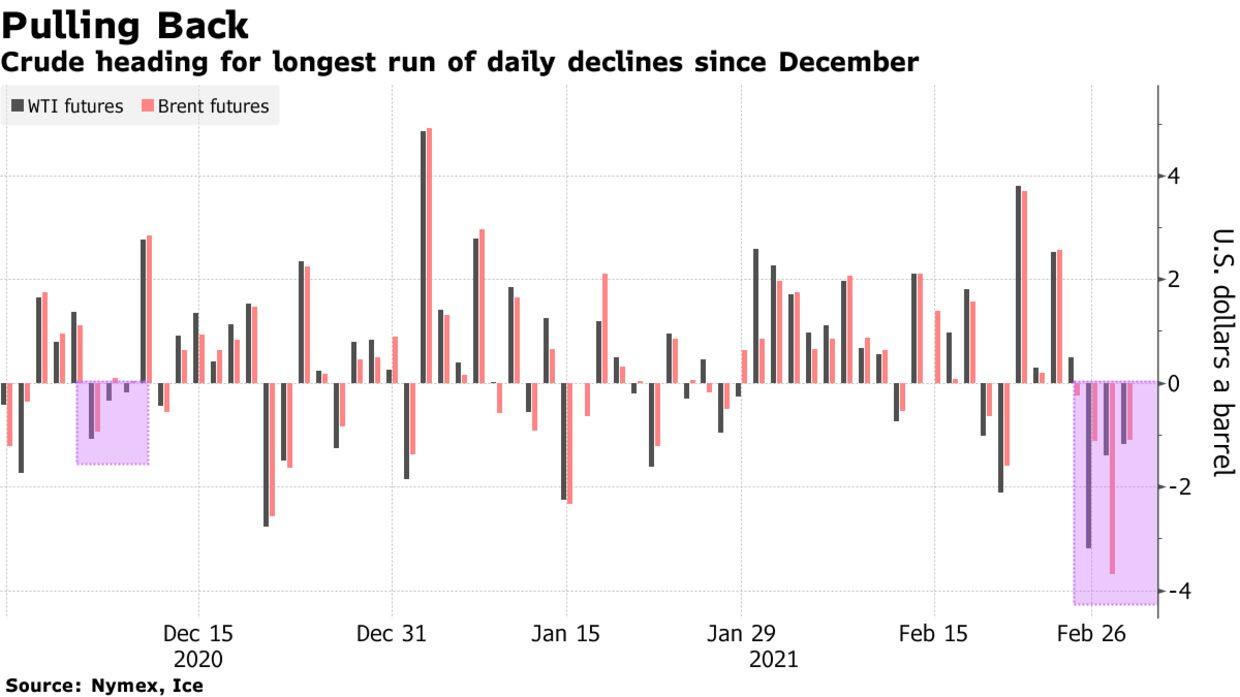

Oil’s impressive 2021 rally is coming unstuck just days before OPEC+ meets to decide just how much crude it should return to the market. Futures in New York traded near $60 a barrel, dropping for a third day to head for the longest losing run since December. The alliance meets on Thursday to decide on easing supply curbs after prices posted their best ever start to a year before the current skid. Ahead of the gathering, Saudi Arabia has urged members to take a cautious approach even as signs of tightening emerge.

The latest decline in prices may help to strengthen the Saudi stance, according to Stephen Innes, chief global market strategist at Axi. “That’s probably something that could sway the OPEC+ increase more back toward the 500,000 barrels per day as opposed to the 1.5 million,” he said.

Crude roared higher in the opening two months of 2021, aided by the deep OPEC+ supply cuts, which include unilateral reductions by the Saudis. The roll-out of vaccines and an investor charge into commodities have also underpinned the gains, which pushed prices in New York to the highest close since 2019.

Investors are “a little bit unsure whether OPEC will continue with the support they provided over the last few months with the supply cuts,” said Daniel Hynes, a senior commodity strategist at Australia & New Zealand Banking Group Ltd. If there’s a higher-than-expected increase, that could make things difficult in the short term given demand is still showing signs of fragility, he said.

| PRICES |

|---|

|