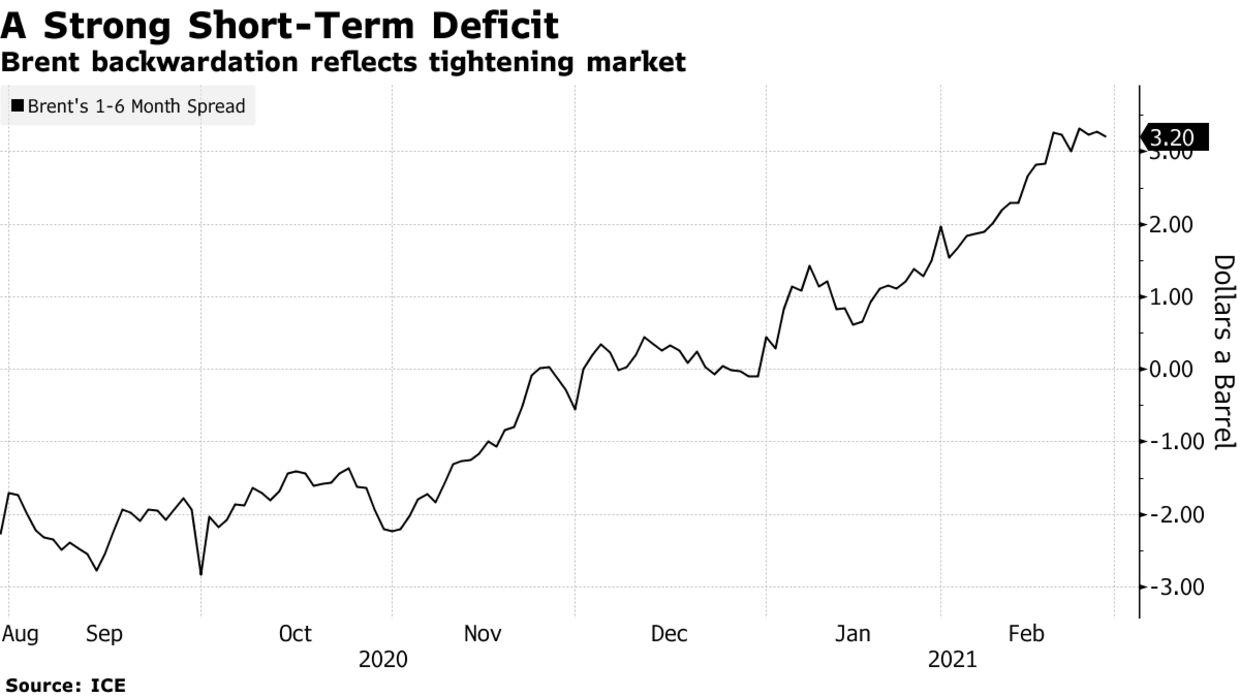

From trading houses in Geneva to Wall Street banks, much of the oil world agrees that global markets could use some more barrels. The big question is whether OPEC+ will provide enough of them. A crude glut that piled up during the pandemic is vanishing fast. Global inventories are plunging at the steepest rate in two decades, according to Morgan Stanley. Prices have rallied to pre-virus levels, while U.S. production has taken a hit from freezing storms. Talk swirls of market supercycles, and even the return of $100 oil.

With the need for more supply evident, traders expect the OPEC+ coalition, led by Saudi Arabia and Russia, will agree to increase production when it meets on March 4, reversing some of the output cuts made last year.

But it’s unclear if the group will act vigorously enough. Wary of the virus’s persisting threat to demand, Saudi Energy Minister Prince Abdulaziz bin Salman has urged fellow producers to remain “extremely cautious.”

If the alliance agrees an output hike that falls short of requirements, however, it could trigger a further price surge — and the group would be forced to deal with its unwelcome consequences.

“There’s a real risk they’re going to over-tighten the market,” said Bill Farren-Price, a director at research firm Enverus and veteran observer of the cartel. “It’s already super-tight, and if OPEC just focuses on keeping prices up, that’s going to eventually provoke supplies from their rivals.”

The Organization of Petroleum Exporting Countries and its allies rescued the global oil industry from an unprecedented slump last year by slashing production when the coronavirus crisis pummeled demand. The strategy has revived international benchmark Brent crude to $67 a barrel, shoring up revenues for the producers’ battered economies.

The 23-nation coalition continues to idle just over 7 million barrels of daily output — about 7% of global supply — and on Thursday will decide whether to revive a 500,000-barrel tranche in April. In addition, the Saudis will confirm whether an extra 1 million barrels they’ve recently taken offline will return as scheduled.