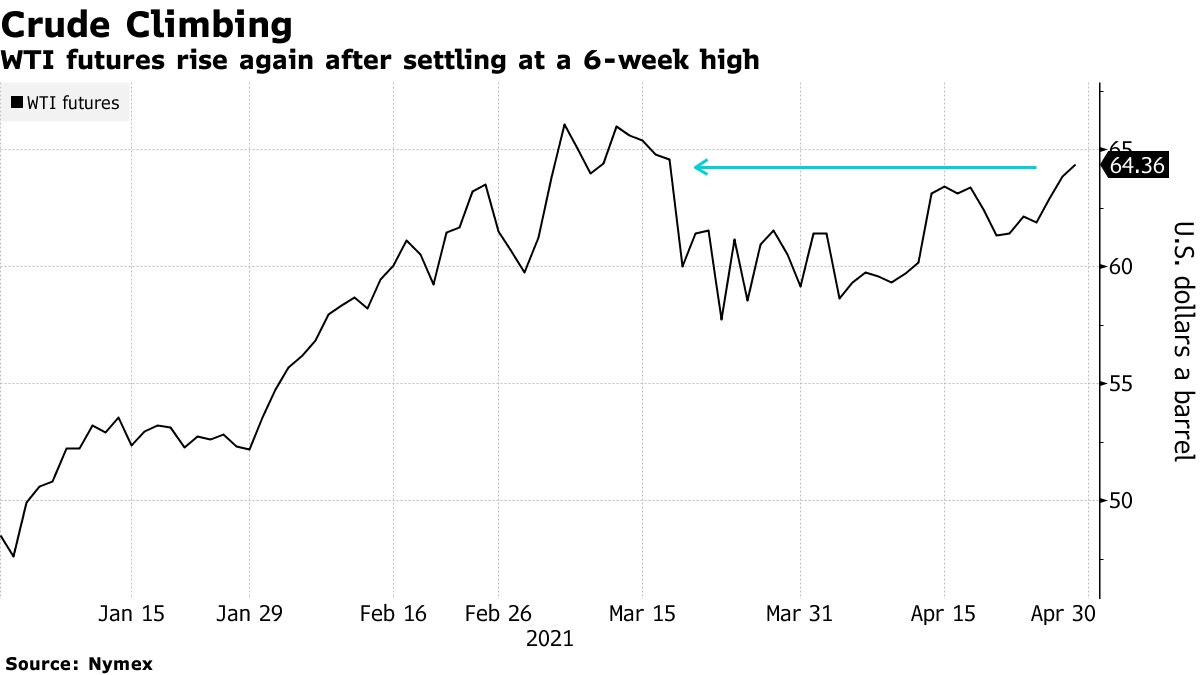

Oil extended gains after closing at a six-week high as signs of strengthening demand in key markets offset concerns a Covid-19 resurgence in some countries, especially India, will damp consumption in the near term. Futures in New York traded above $64 a barrel after climbing more than 3% over the previous two sessions. A gauge of demand for U.S. petroleum products increased last week to the highest in more than two months. Fuel demand may get another boost as China breaks for an extended holiday on Saturday, with mobility expected to climb to a record.

There has been a chorus of bullish voices on the outlook for crude this week, including a prediction from Goldman Sachs Group Inc. that oil demand will post a record jump over the next six months as vaccination rates accelerate. OPEC+ also raised its estimates for growth this year, but the alliance cautioned a worsening virus situation in India, Japan and Brazil could derail the recovery.

“Demand will be zooming back in the U.S. as the economy opens up further,” said Bjarne Schieldrop, chief commodities strategist at SEB AB. “There will be weakness in India. But it is highly visible for OPEC+ and they can react at next meeting if necessary.”

| PRICES |

|---|

|

The short-term risks to the demand outlook are starting to show up in gauges of market health. The structure of the Middle Eastern Dubai benchmark flipped into a slight contango on Thursday, an indication that market tightness may be easing. The nearest portion of the Brent futures curve has also weakened.