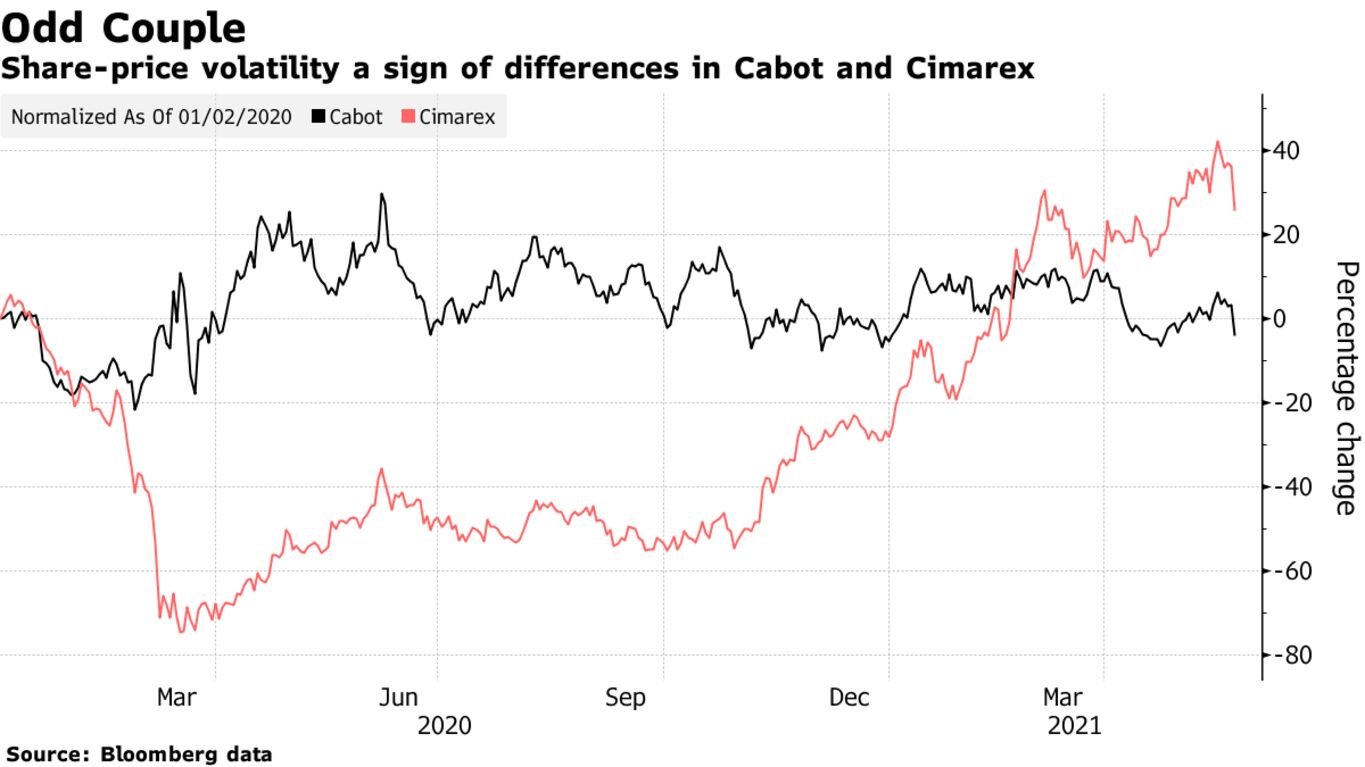

Shale investors have been demanding more consolidation in the oil patch. But not exactly a deal like this one. The merger of Cabot Oil & Gas Corp. with Cimarex Energy Co. announced Monday has confounded investors and analysts, leaving them to question the logic behind a tie-up that the companies say will increase diversification. Cimarex is mostly an oil explorer in Texas and Oklahoma, while Cabot is focused on natural gas drilling in the Marcellus shale basin in Appalachia.

Analysts at Citigroup Inc. said the deal — an all-stock transaction valued at about $7.4 billion — is an unexpected pairing as it creates geographic diversity, unlike other major industry transactions recently. KeyBanc Capital Markets Inc. downgraded shares of Cimarex because of the lack of a premium and what it views as no clear strategic benefit to investors. Bloomberg Intelligence said a Permian-focused partner would have made far more sense for Cimarex.

“This deal comes as a bit of a surprise and may have a less clear story to tell investors,” Andrew Dittmar, an analyst at Enverus, wrote in a statement. “Some investors may wonder why in-basin opportunities weren’t pursued ahead of a surprising multi-basin deal.”

Deal-making in the shale patch has picked up following a rebound in oil prices from their pandemic-era lows. The number of U.S. exploration and production deals announced or closed this year have more than quadrupled to about $26 billion from the same period a year earlier, Bloomberg data show.

By contrast, enthusiasm permeated through markets two weeks ago when Bonanza Creek Energy Inc. and Extraction Oil & Gas Inc. announced an all-stock deal valued at about $1.1 billion that will combine assets in Colorado. The merger — a low-premium deal — was favored among shareholders, as it aims to build on the companies’ existing footprint in the area. Shares for Bonanza and Extraction surged as a result.

“I realize this one is a little different than many of the others,” Jorden said. “We’re not terribly focused on the short-term here.”