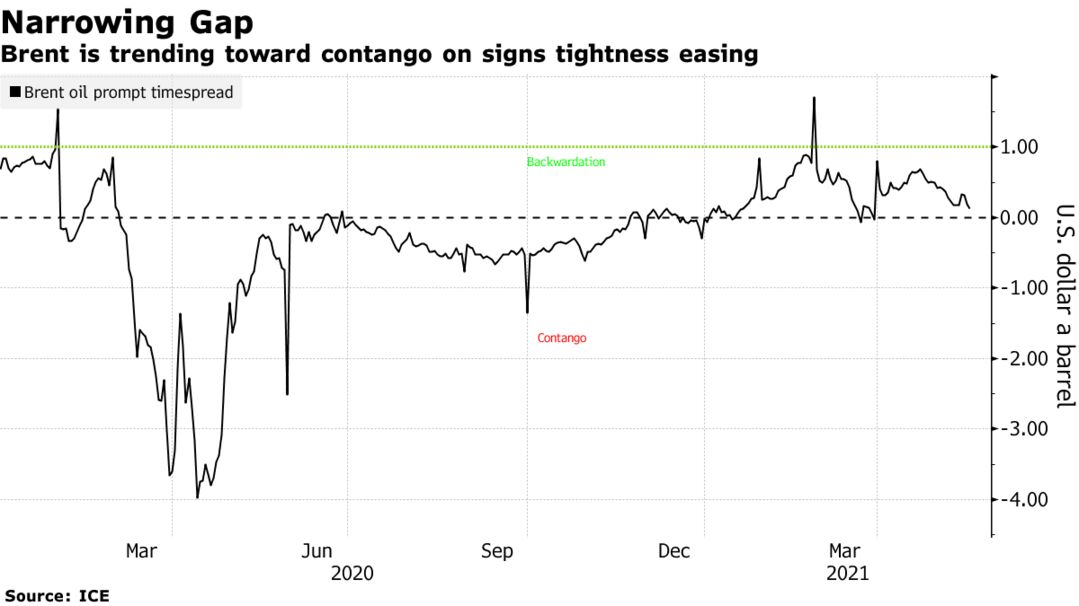

Brent oil edged higher from the lowest settlement in three weeks as investors assessed the prospect of a boost in Iranian supply just as OPEC+ returns more barrels to the market.Futures in London — which briefly rose above $70 a barrel earlier this week — added 0.4% after sliding 3% on Wednesday amid a broader market rout. A top European Union official said the U.S. and Iran are close to reviving a nuclear deal, which would allow more oil flows from the OPEC producer. The possibility of more supply is being reflected in Brent’s prompt timespread, with its backwardation narrowing in a sign market tightness may be easing.

Oil is still up almost 30% this year as the recovery from the Covid-19 pandemic accelerates in the U.S. and parts of Europe, while purchasing of crude cargoes from countries such as China remains robust. However, the flare-up across Asia is a constant reminder that the rebound is expected to be uneven and bumpy. The second wave in India has trimmed sales of gasoline and diesel by as much as 20% for top refiner Indian Oil Corp., prompting cuts to processing rates.

| PRICES |

|---|

|

Enrique Mora, the EU official in charge of coordinating diplomacy in Vienna for the nuclear talks, said he expects all parties to return to the 2015 agreement before Iran’s presidential elections on June 18. Citigroup Inc. sees an initial 500,000 barrel-a-day increase from around the middle of the third quarter. Iran has already been bringing back output, and said it will soon export oil from a new port, which would allow the country to bypass the Strait of Hormuz.

The prompt timespread for Brent was 14 cents a barrel in backwardation — a bullish structure where near-dated contract are more expensive than later-dated ones. That compares with 42 cents at the start of May.