Oil headed for a second straight weekly advance as investors bet on rising energy demand amid a broad rally in commodities, with robust trade data from China highlighting the strength of the global economy. West Texas Intermediate gained 0.7%, rebounding from a drop on Thursday. The U.S. benchmark has risen 2.5% this week and is on pace for the first back-to-back weekly increase since early March as vaccine-aided economic activity picks up in the U.S., Europe and China. That’s offsetting concern about resurgent coronavirus waves elsewhere, including in key crude importer India.

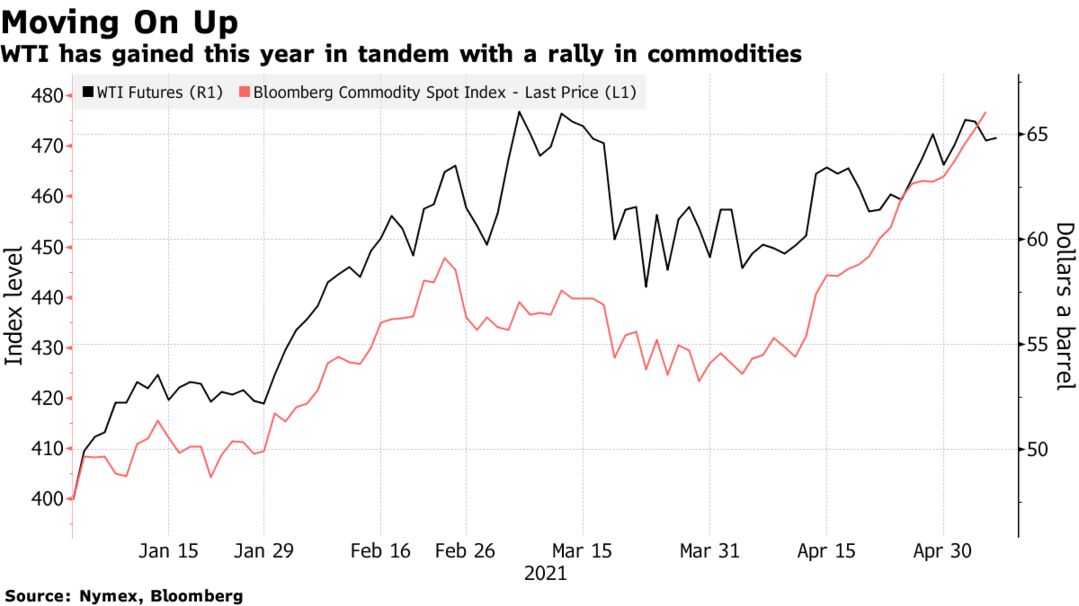

Crude has rallied in 2021 as investors target assets that will prosper on the recovery from the pandemic. The gains were buttressed by supply cuts from the Organization of Petroleum Exporting Countries and its allies, although these are now being relaxed, and record monetary support from the Federal Reserve. U.S. payrolls data later Friday will yield fresh insights into the rebound.

“Brent at $68 to $69 appears to be broadly in equilibrium, having factored in the U.S.-Europe reopening optimism and the Covid hotspots across Asia and Latin America,” said Vandana Hari, founder of Vanda Insights. “The worst of India news has been baked in. I don’t see it delivering bigger shocks to oil.”

Figures from China on Friday showed total exports rose more than expected in April and imports climbed, reflecting strong domestic and international demand as well as surging commodity prices. Energy consumption in Asia’s largest economy has rebounded from last year’s pandemic-driven slump, with crude imports swelling by more than 7% in the first four months of 2021.

| PRICES: |

|---|

|

Oil’s powerful climb forms part of a wide advance in raw materials that has propelled the Bloomberg Commodity Spot Index to the highest level since 2011. With copper hitting a record on Friday, that gauge is on course for its fifth consecutive weekly rise, the best run of gains since August.