The U.S reduced its forecast for oil output through 2022 as drillers across the prolific shale patch pledge austerity over the allure of increasing prices. Oil explorers throughout the country will produce 20,000 barrels a day less than previous forecasts for this year, at 11.02 million barrels. Supply next year is set to reach 11.84 million barrels day, down from prior estimate of nearly 11.9 million, the Energy Information Administration said in a report Tuesday. This marks the second straight downward revision for 2021 and 2022 forecasts.

Still, pressure from Wall Street investors has put a lid on any potential supply growth, forcing drillers to increase cash flow and dividends to shareholders. In their quarterly earnings calls last month, the largest U.S. drillers, Chevron Corp. and Exxon Mobil Corp., indicated they are holding firm to austerity measures adopted during last year’s pandemic-fueled crisis, easing concerns that recent price recovery would spur another round of runaway production growth.

With the U.S. unlikely to return to previous peak output, the Organization of Petroleum Exporting Countries and its allies have moved to roll back part of their supply cuts starting in May. OPEC itself boosted estimates for the call on its output this year by a modest 230,000 barrels a day as supply from the group’s biggest rival declines again.

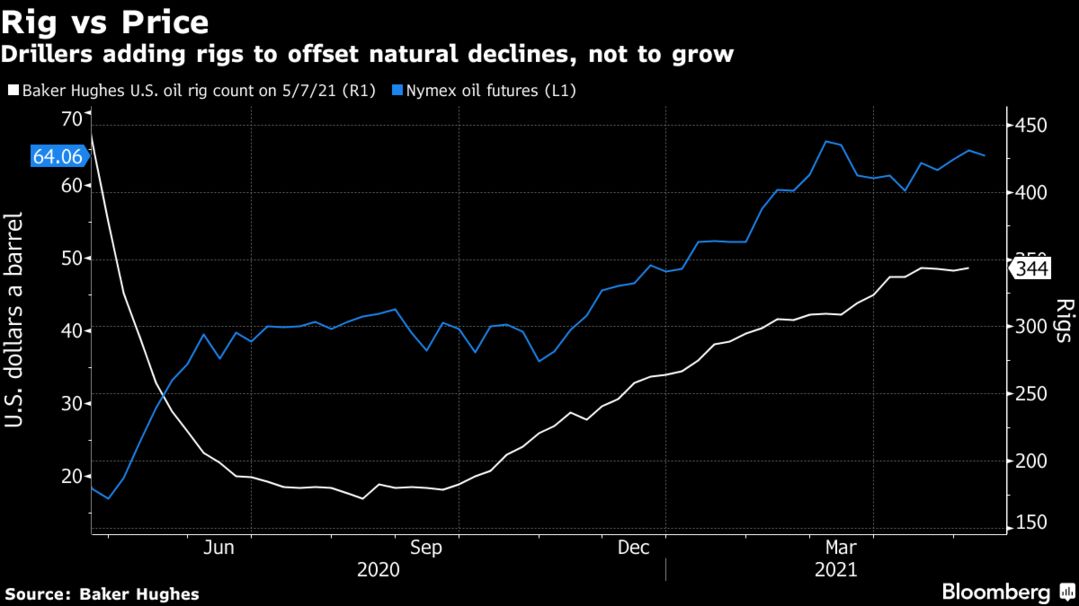

Nonetheless, the EIA expects producers to add new wells while oil prices stay above $55 a barrel, but only enough to offset natural declines from existing wells. Oil supply will also benefit from the new projects in the U.S. Gulf of Mexico, the agency said in its Short-Term Energy Outlook. It added that the nation has fully recovered from February’s cold snap-related supply outages, with volumes rebounding more than 1 million barrels a day to nearly 11 million barrels a day in April.