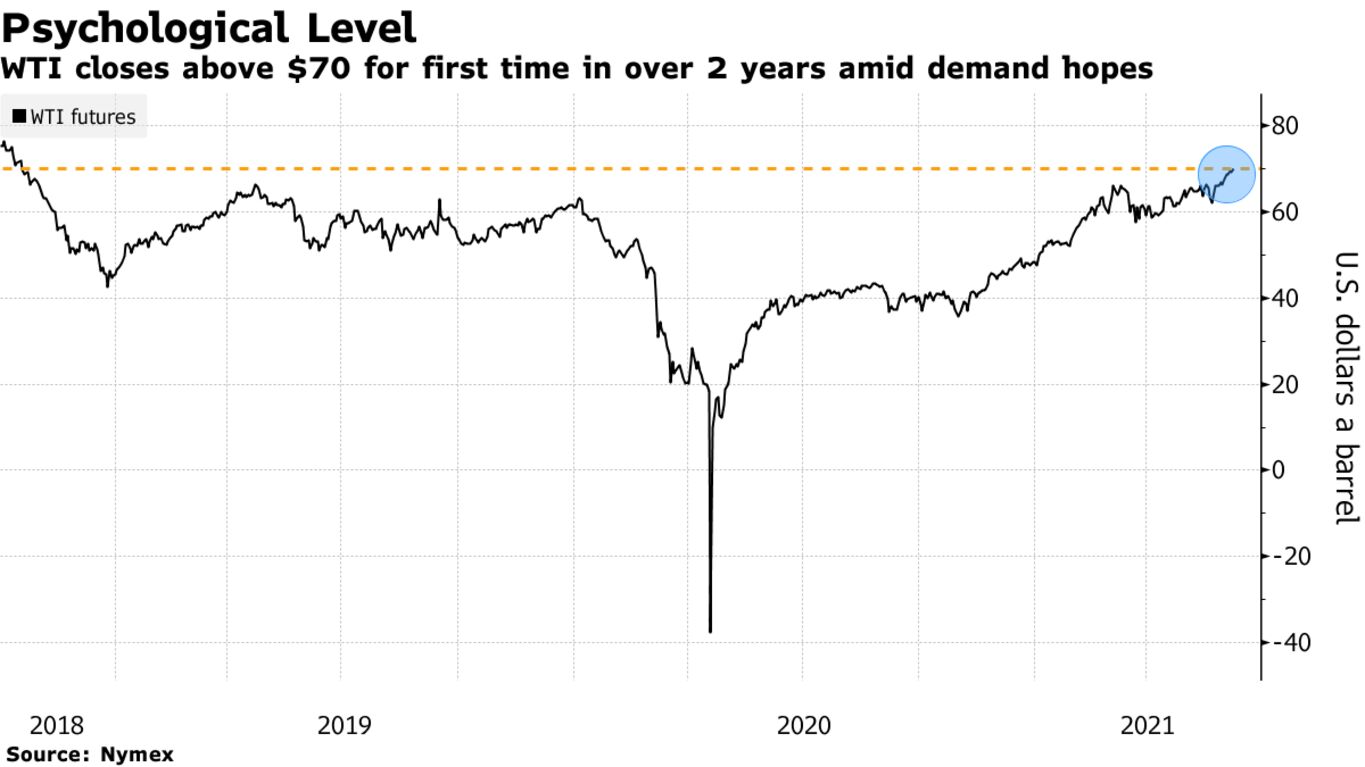

Oil resumed its rally to top $70 a barrel in New York as investors grew more confident that accelerating vaccinations and easing travel restrictions will continue to boost demand. West Texas Intermediate futures surpassed the $70 mark to close at its highest since Oct. 2018 after briefly touching the key psychological level earlier this week. Investors focused on the health of the U.S. market ahead of inventory data on Wednesday.

Confidence in the outlook for oil demand continues to grow as accelerating vaccinations allow people to travel more. The Middle Eastern Dubai benchmark is trading in its steepest backwardation — a market structure that indicates supply tightness — in almost a year after the region’s physical market had a strong start to the month. “There’s all sorts of technical models that work off closing prices,” said Bill O’Grady, executive vice president at Confluence Investment Management in St. Louis. “Any time you have a close above a number divisible by 5, it tends to be pretty significant” in attracting flows such as those from commodity trading advisors.

Crude’s advance from 2020’s collapse has stalled a handful of times this year, but prices have usually returned to an upward track as overall global demand keeps improving. The Covid-19 comeback in part of Asia and Latin America, however, is a reminder that the rebound will be bumpy. “We’re looking for a pretty sizable drawdown in U.S. crude oil inventories, while the demand thesis keeps improving,” said John Kilduff, a partner at Again Capital LLC. “This atmosphere remains bullish, as we’re heading into a structural deficit in terms of supply versus demand.”

| PRICES |

|---|

|

WTI’s discount against Brent is on the move again after surging to the narrowest since November last month. With the narrowness in the spread persisting, U.S. exports may see a dip as WTI loses competitiveness.