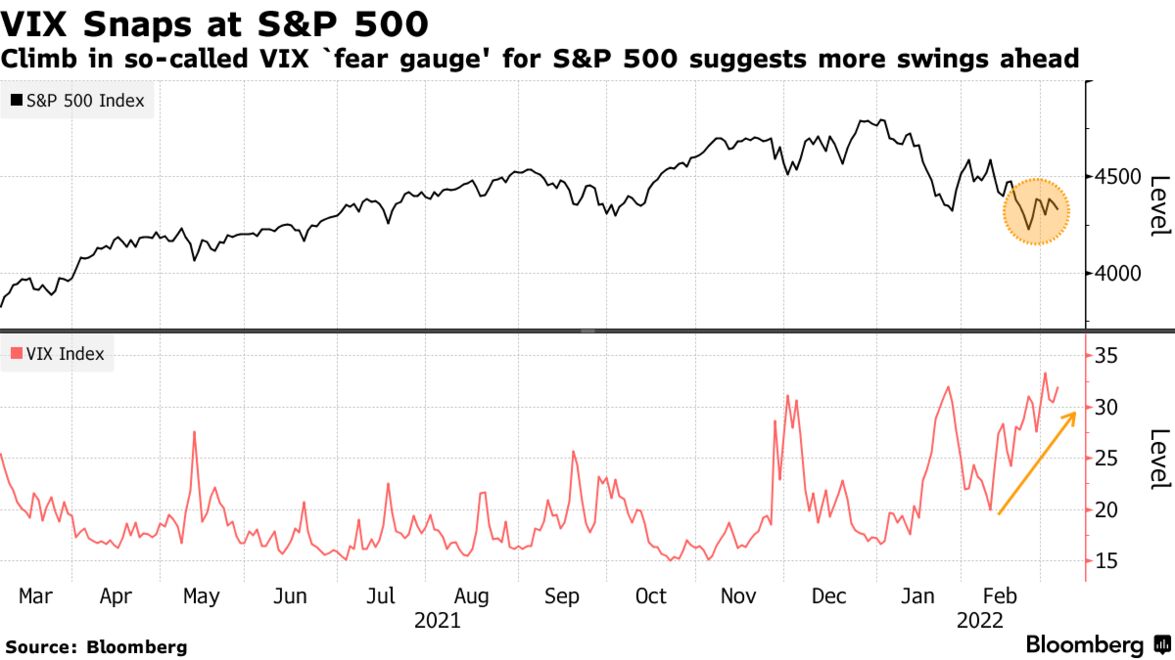

Expectations for the S&P 500 index are buckling under the clamor of inflation and economic growth worries stoked by crude oil’s rally.

The U.S. equity gauge may drop to 4,000 by the end of 2022 — a fall of some 8% from current levels — according to Yardeni Research, which last month had a target of 4,800. Evercore ISI cut its outlook to 4,800 from 5,100.

“We see a more stagflationary outlook with persistently higher inflation and less economic growth,” Yardeni’s Chief Investment Strategist Ed Yardeni wrote in a note, adding a recession can’t be ruled out given the jump in oil.

Crude soared Monday to the highest since 2008 on the prospect of a ban on Russian barrels by the U.S. and its allies in retaliation for invading Ukraine. Grain and metals have also surged amid fears of disarray in commodity flows due the war and the transformation of raw-material rich Russia into a pariah.

The conflict and the price shock could chill investment and consumer spending just as the Federal Reserve prepares to embark on a series of interest-rate hikes to damp inflation, which was already high on pandemic-era effects.

A test of 3,670 on the S&P 500 isn’t a base case but can’t be ruled out, Julian Emanuel, chief equity strategist at Evercore ISI, wrote in a note.

He’s previously mentioned that level, a drop of about 15% from Friday’s close, as one that might trigger the “Fed put,” referring to the idea that the Federal Reserve could take steps to help stabilize markets.

“The ‘Cold War Peace Dividend’ — a secular decline in yields, driven first by inflation’s decline then the ‘Great Moderation’ — has ended,” he said.

Selloff

Stocks and U.S. equity futures sold off Monday while havens including gold and Treasuries rallied. The two-year to 10-year U.S. yield curve is around the flattest since March 2020, signaling expectations for slower growth.

As of mid-February — before Russia invaded Ukraine — the median year-end target for the S&P 500 among strategists tracked by Bloomberg was 5,000. It closed Friday at 4,328.87.

The index has climbed 2.5% since Russian President Vladimir Putin commenced the invasion, compared with a 7% plunge in European shares and near-4% retreat in Asia.

Wage-Price Spiral

Fed Chair Jerome Powell last week indicated the U.S. economic recovery is resilient enough to weather the range of challenges that have flared up. Yardeni sees the S&P 500 rebounding to 5,000 in 2023.

A recession call for the U.S. isn’t warranted given the “stupendous” number of job openings, said Brian Barish, who manages about $5.7 billion as chief investment officer at Cambiar Investors LLC.

“What seems more likely in the U.S. is that inflationary expectations and a wage-price spiral, which has been pooh-poohed by practically everybody, has a far better chance of happening,” Barish said. “Which is not good for stock