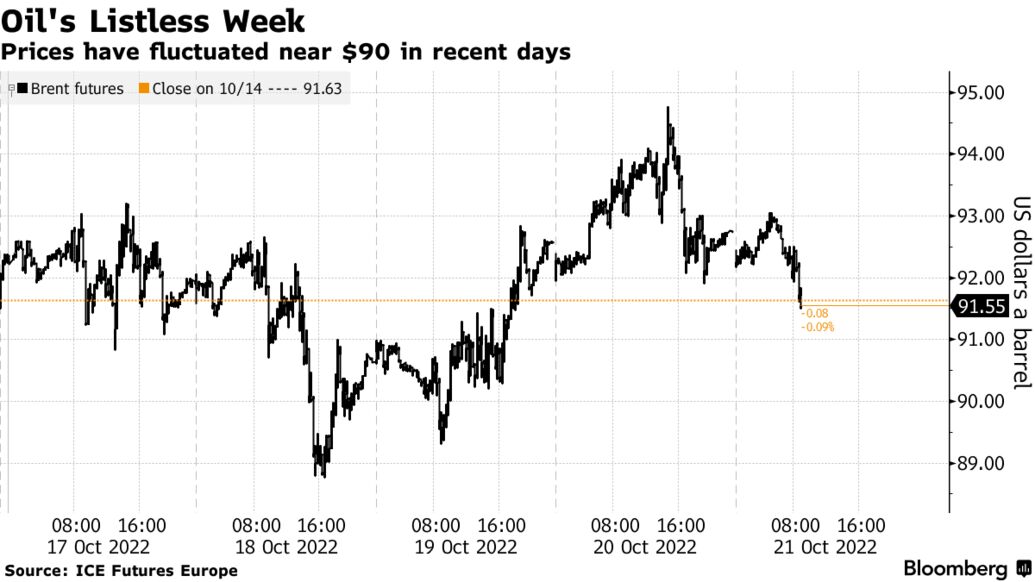

Oil retreated on Friday after a volatile week as concerns over a global economic slowdown continue to hang over the market.

Benchmark Brent futures traded near $91 a barrel amid risk-off sentiment across markets as bond yields surge. Investors are juggling slowdown fears against signs of oil market tightness, while fluctuating risk sentiment in broader markets has regularly whipsawed crude prices.

Oil has a lost a third of its value since early June due to slowdown concerns and aggressive monetary policy from central banks to tame inflation, However, the market is facing a period of supply uncertainty in coming months as OPEC+ cuts output and the European Union implements sanctions on Russian flows.

“This has been a week where markets once again have been led by US bond yield developments,” said Ole Hansen head of commodities strategy at Saxo Bank A/S. “Surging bond yields point to more pain regarding rate hikes and with that the risk of lower economic activity.”

The impact of the looming sanctions on Russia, which will include petroleum products from early next year, is already filtering through the broader market. Croatia is working to wean its refinery off of Russian feedstock, while some Indian refiners have halted new spot purchases.

| PRICES: |

|---|

|

Brent remains steeply backwardated, a bullish structure where near-dated contracts are more expensive than later-dated ones. The prompt time spread was $1.86 a barrel in backwardation, compared with $1.48 a week earlier.

The outlook for Chinese demand also remains uncertain. President Xi Jinping signaled on Sunday that the nation would stick with its Covid Zero policy, but officials are said to be in debating whether to cut quarantine for inbound travelers. Recent oil buying by refiners has also been lackluster.

e.