Agricultural commodity buyers from Cairo to Islamabad have been on a shopping spree since the Covid-19 pandemic upended supply chains. Jordan has built up record wheat reserves while Egypt, the world’s top buyer of the grain, took the unusual step of tapping international markets during its local harvest and has boosted purchases by more than 50% since April. Taiwan said it will boost strategic food stockpiles and China has been buying to feed its growing hog herd.

The early purchases underscore how nations are trying to protect themselves on concerns the coronavirus will disrupt port operations and wreak havoc on global trade. The pandemic has already upset domestic farm-to-fork supply chains that provided just enough inventory to meet demand, with empty store shelves across the world leading consumers to change their shopping habits.

| COUNTRY | ACTION TAKEN |

|---|---|

| Jordan | Further adding to wheat stockpiles already at 17 months of supply |

| Egypt | Purchases through international tenders up 51% since April |

| Morocco | Allowed duty-free wheat imports for rest of 2020 |

| Pakistan | Currently boosting purchases of wheat and sugar |

| Taiwan | Announced plans to boost food reserves |

| China | Increased purchases under phase one of U.S. trade deal |

Some countries decided to bring their food purchases forward to ensure supplies in case the coronavirus rattles supply chains, said Abdolreza Abbassian, a senior economist at the UN’s Food and Agriculture Organization. Only a handful really sought to boost strategic reserves, such as Egypt and Pakistan, but they also had other reasons to do so including access to foreign currency, the size of domestic supplies and the need to keep domestic prices in check.

Bad harvests in Turkey and Morocco added to their need to boost imports.

“Many may buy now but could buy less into the new year because they won’t need it,” Abbassian said in a telephone interview from Rome, referring to early purchases. “I could see that happening, especially as winter wheat conditions are not that great and if you wait, prices could rise further.”

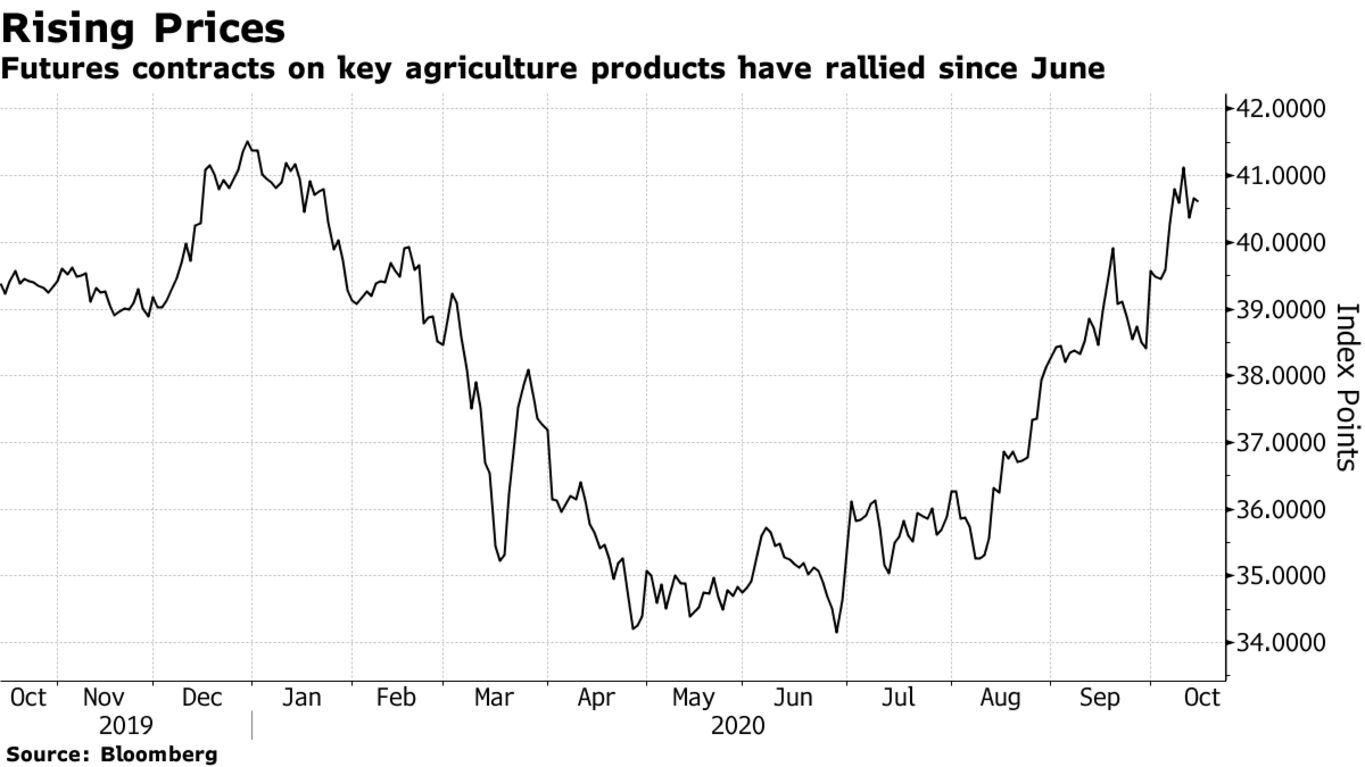

Agricultural prices have been on the rise as countries stepped up purchases, adding to demand from China and a drought in the Black Sea region. That has helped push the Bloomberg Agriculture Subindex, which measures key farm goods futures contracts, up almost 20% since June. Sugar prices have gained a boost as China replenished stockpiles, said Geovane Consul, chief executive officer of a Brazilian sugar and ethanol joint venture between U.S. agribusiness giant Bunge Ltd. and British oil major BP Plc.

And China could still add more fuel to the fire next year. The biggest importer of everything from crude oil to iron ore and soybeans, is planning to increase its mammoth state reserves as part of its five-year plan.

“China would certainly support commodities prices if it made such extensive purchases,” Commerzbank AG Analyst Daniel Briesemann said in a research note.