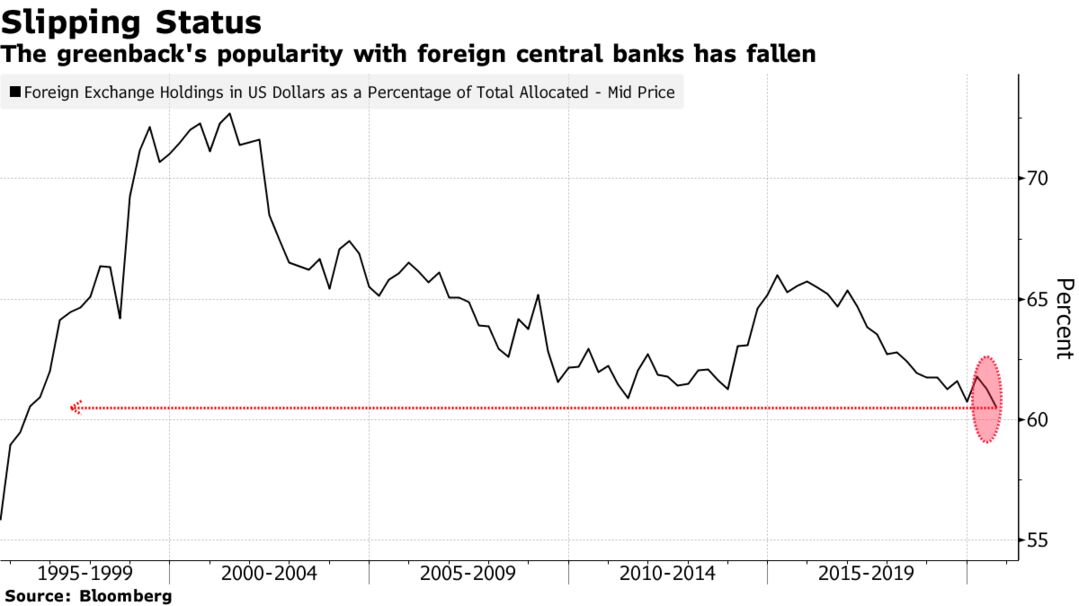

China’s light-speed recovery from the pandemic has reignited the perennial debate about how long the dollar’s 50-year dominance of global markets can persist. The U.S.’s struggle to control the coronavirus and revive its economy contrasts sharply with the Asian nation, where growth has roared back. That divergence — which saw the greenback’s worst performance since 2017 as the yuan advanced — has bolstered China’s tilt at dollar hegemony, with investors flocking to onshore assets, trying out the renminbi for trade, and even giving it another look as a reserve currency.

The dollar’s demise as the world’s reserve currency has been idly speculated on and predicted for years, of course. Prior to the yuan, all the hype was about the euro as the dollar’s successor. Nothing, though, ever managed to dent the twin forces underpinning dollar supremacy: the U.S.’s role as both global growth engine and haven of first choice for investors during crises. So powerful were these two pillars that they were given a catchy nickname in trading circles years ago — the “dollar smile.”

But recently, that smile has looked more like a smirk, with the virus eroding both of the currency’s traditional supports. Instead, it’s the yuan that’s benefiting from demand for economic outperformance, and for assets insulated from the pandemic’s fallout, bringing the currency’s long-term prospects back into focus.

“The center of the world’s economy is shifting from the Northern Atlantic, where it’s been for 500 years, to the Pacific,” said Marc Chandler, chief market strategist at Bannockburn Global Forex. “The currency markets are going to reflect that over time.”

Yuan Smile

It’s a somewhat ironic end to President Donald Trump’s pursuit of a weaker dollar. Despite frequently admonishing Beijing officials for keeping a lid on their currency to support Chinese exports at the expense of the U.S. — and starting a full-blown trade war to force their hand — it took a pandemic to change the tide.

China is reaping the rewards. The world’s second-largest economy is now set to depose the U.S. as the leading engine of growth in 2028, five years earlier than expected just a year ago after better weathering the pandemic, the Centre for Economics and Business Research said last month.

While American output is poised to rebound in 2021, growing 3.9%, China is on track to expand more than 8%. And its central bank is considering tightening monetary policy — in stark contrast with a pledge from the Federal Reserve to remain accommodative, which has helped drag down the dollar.